Debit Note And Credit Note Format In Gst

However there are circumstances when an already issued invoice needs to be amended due to the rejection of a few products or add up a few products as the case may be.

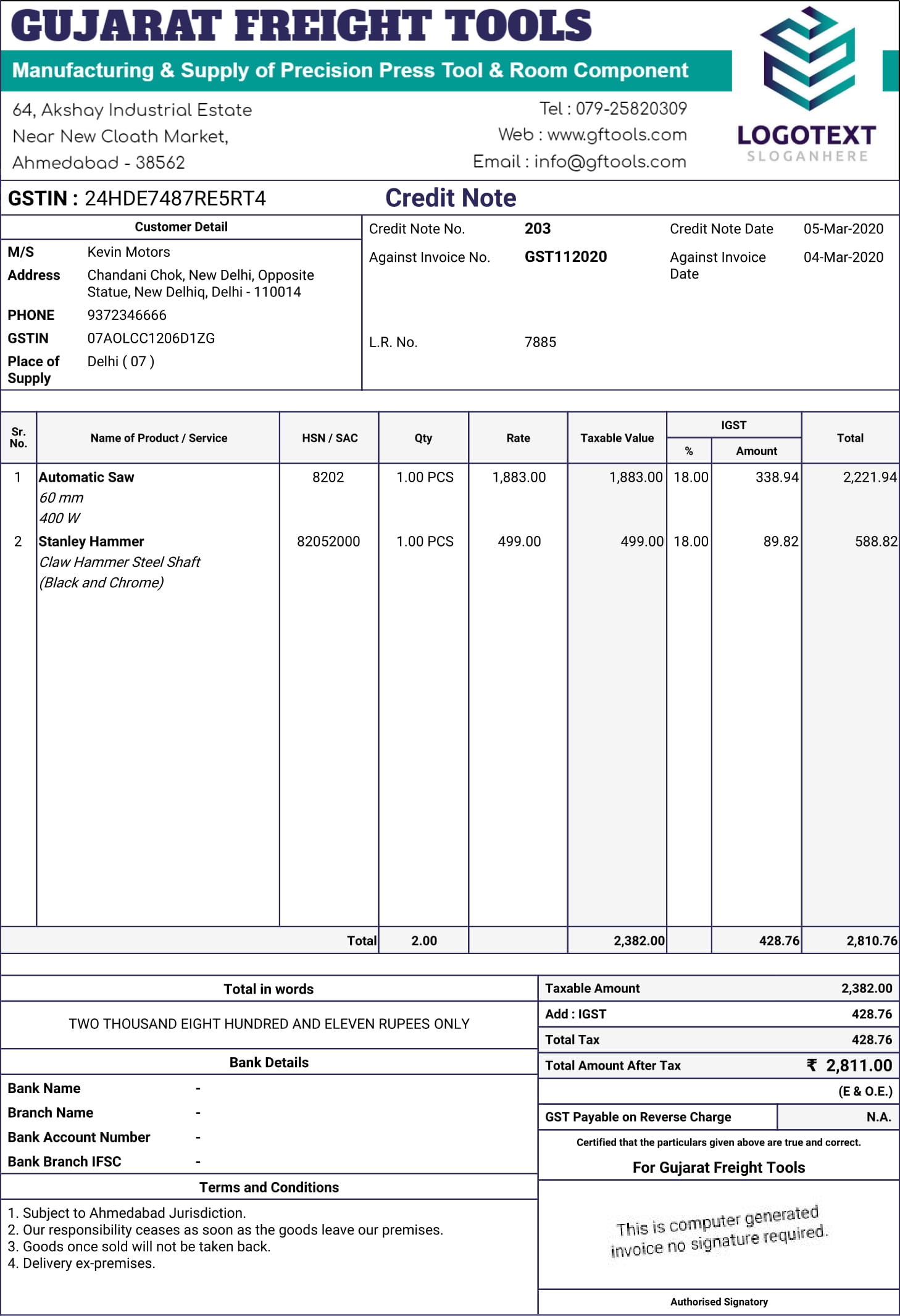

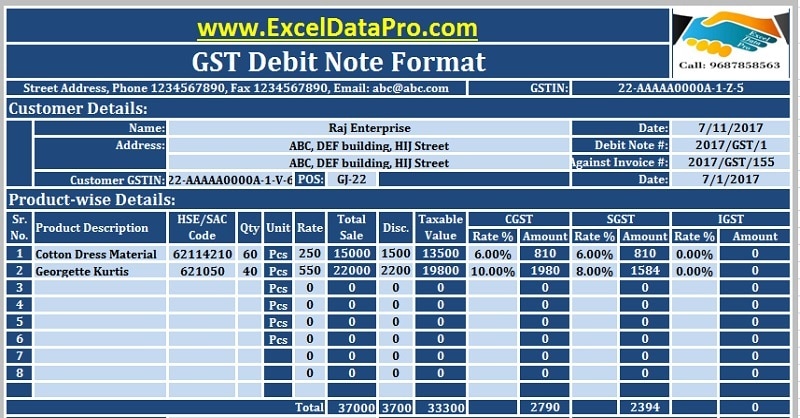

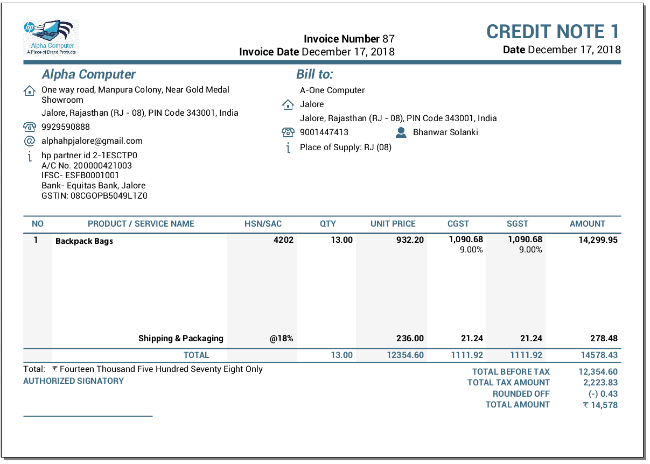

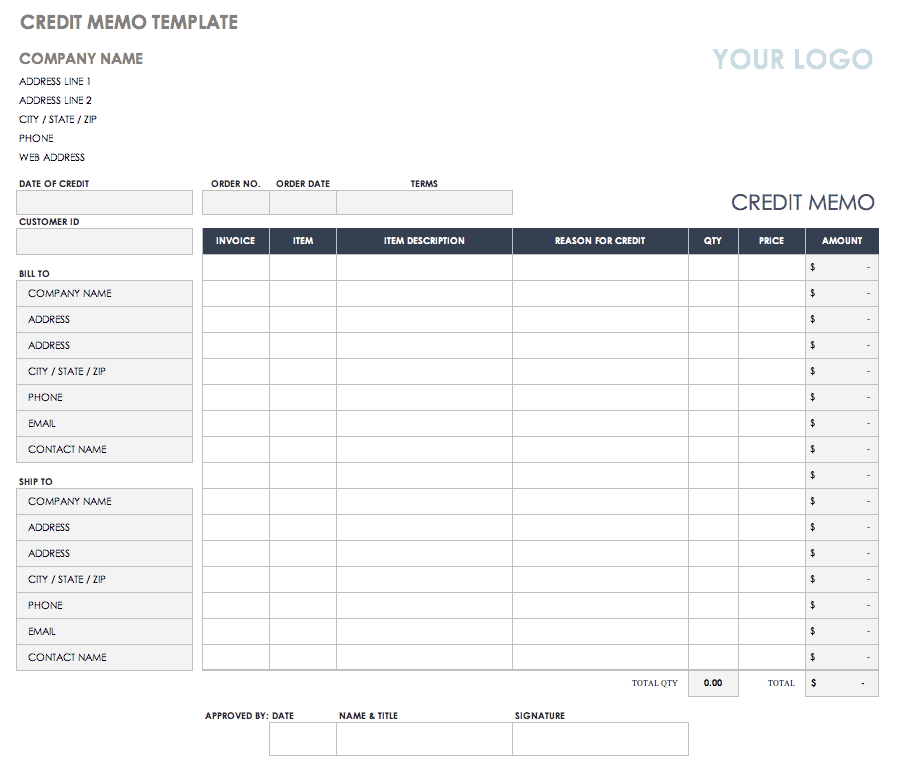

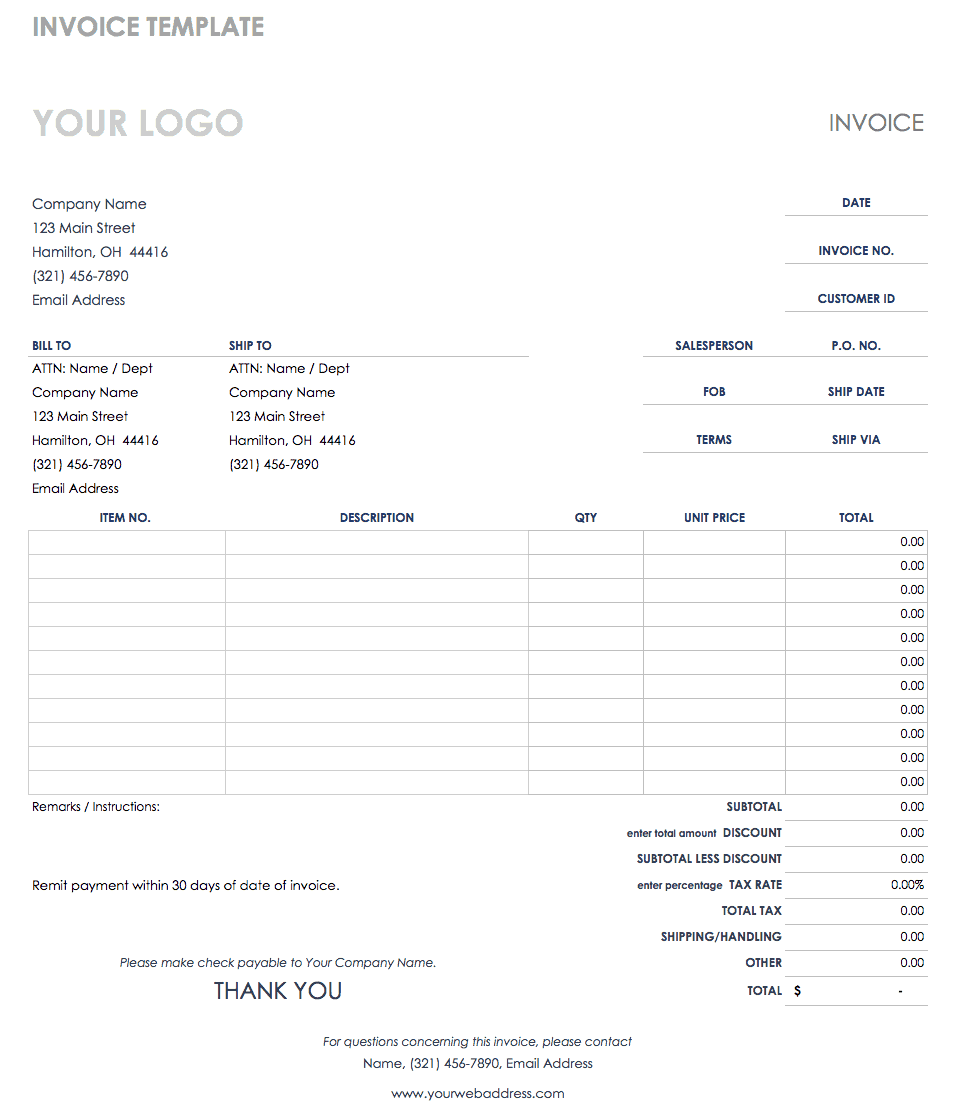

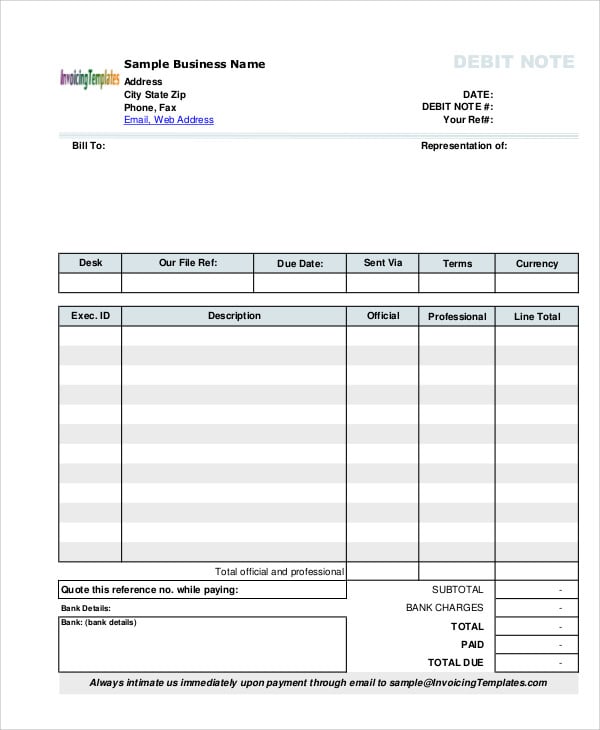

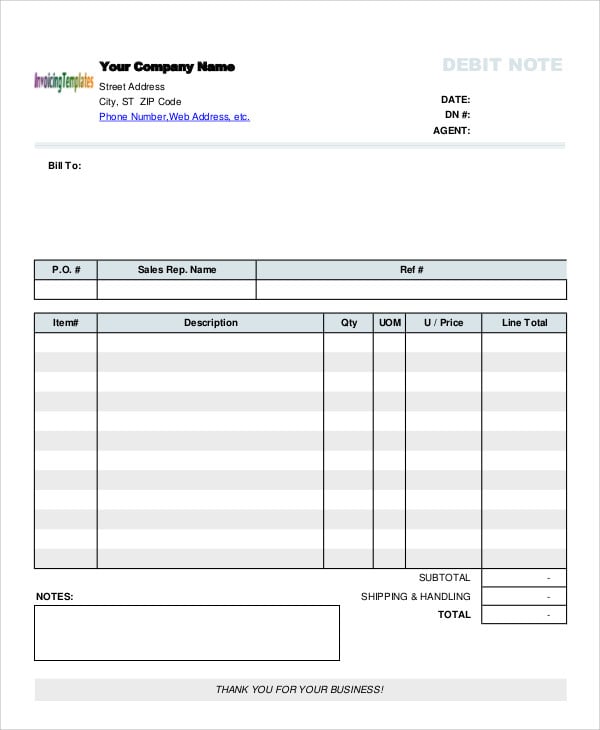

Debit note and credit note format in gst. Name address and gstin of the supplier. There is no prescribed format for debit credit note. Name address gstin or uin in unregistered of recipient. However it must contain prescribed particulars same as a revised tax invoice which includes the following.

Nature of the document. Credit note or debit note. Based on the gst rules and guidelines a credit debit note should contain. Debit note in gst details of debit notes issued should be furnished in form gstr 1 for the month in which the debit note is issued.

Supplier who is issuing credit note debit note will declare the details of credit note debit note issued under gstr 1 of that month or later but not later than september following the end of the financial year in which such supply was made or the date of furnishing of the relevant annual return whichever is earlier. However such a debit note has no relevance under gst. Name address and gstin of supplier. Gst credit note debit note format in india in a business suppliers issue gst invoices quite frequently.

A unique serial number for the current financial year. For the purpose of gst both debit and credit note need to be issued by the supplier of goods or services. What is the credit note debit note format. Format of debit note and credit note.