Renovation Capital Allowance Malaysia 2017

03 21731288 printed in malaysia by sp muda printing services sdn bhd 906732 m 82 83 jalan kip 9 taman perindustrian kip kepong 52200 kuala lumpur tel.

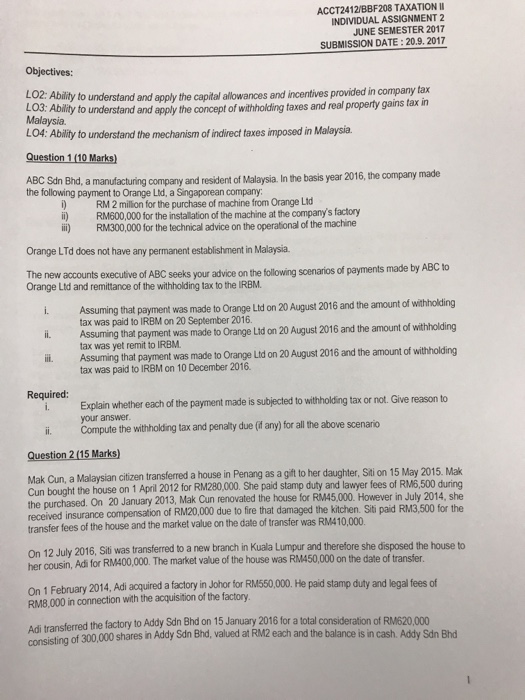

Renovation capital allowance malaysia 2017. 50706 kuala lumpur malaysia tel. Grant amount the grant co funds 75 of the cost incurred to run the programme up to rm100 000 00 per applicant employer per year the grant amount is equivalent to a returnee s one month salary up to rm100 000 per employer per year submission period application must be made by 31st december 2017. 3 2018 date of publicaton. 8 june 2017 income tax treatment of goods and services tax part ii qualifying expenditure for purposes of claiming allowances public ruling no.

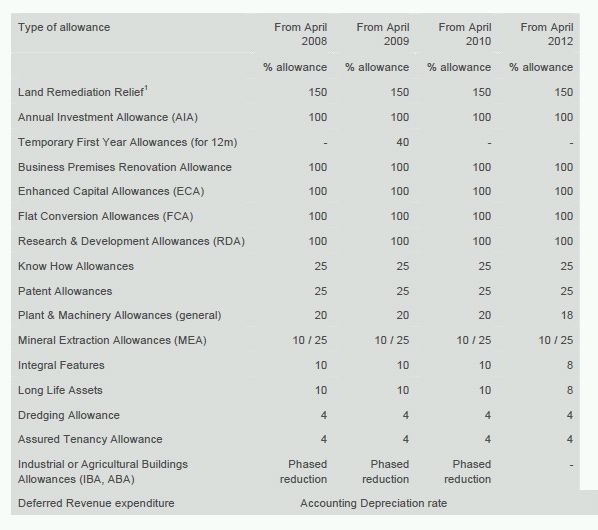

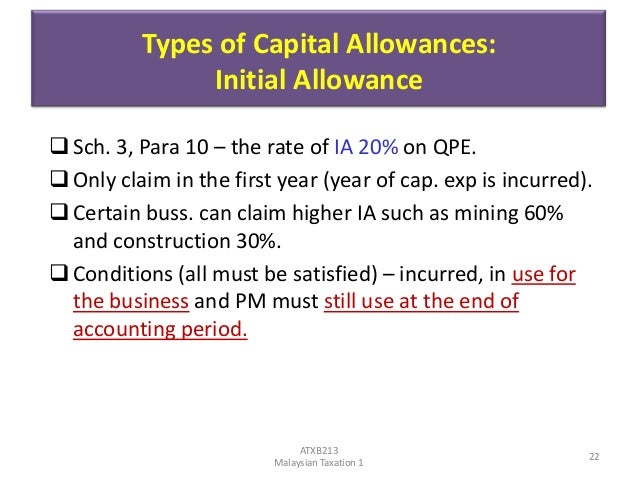

Type of asset initial allowance rate annual allowance rate heavy machinery and motor vehicles 20 20 plant and machinery general 20 14 others 20 10 assets with a life span of not exceeding 2 years replacement basis initial allowance annual allowance. 12 september 2018 page 2 of 27 4. 8 oktober 2018 inland revenue board of malaysia page 2 of 19 4 3 the conditions that must be fulfilled by a person to qualify for an initial allowance ia and an annual allowance aa are the same as the conditions to claim capital allowances at the normal rate under schedule. Capital allowance is given as deduction from business income in place of depreciation expenses incurred in purchase of business assets.

Small value assets not exceeding rm2 000 each are eligible for 100 capital allowances. Capital allowances consist of an initial allowance and annual allowance. 7 2018 date of publication. Inland revenue board of malaysia qualifying expenditure and computation of industrial building allowances public ruling no.

Initial allowance is fixed at the rate of 20 based on the original cost of the asset at the time when the capital expenditure is incurred. Qualifying building expenditure qbe is capital expenditure incurred by a person on the cost of. The value of the asset is increased from rm1 300 to rm2 000 and the total capital allowances capped is increased from rm13 000 to rm20 000 w e f. Be between 1st january 2017 until 31st december 2017.

Examples of assets used in a business are motor vehicles machines office equipment furniture and computers. The total capital allowances of such assets are capped at rm20 000 except for smes as defined.