Company Tax Computation Format Malaysia 2020

A direct tax is a tax that is levied on a person or company s income and wealth.

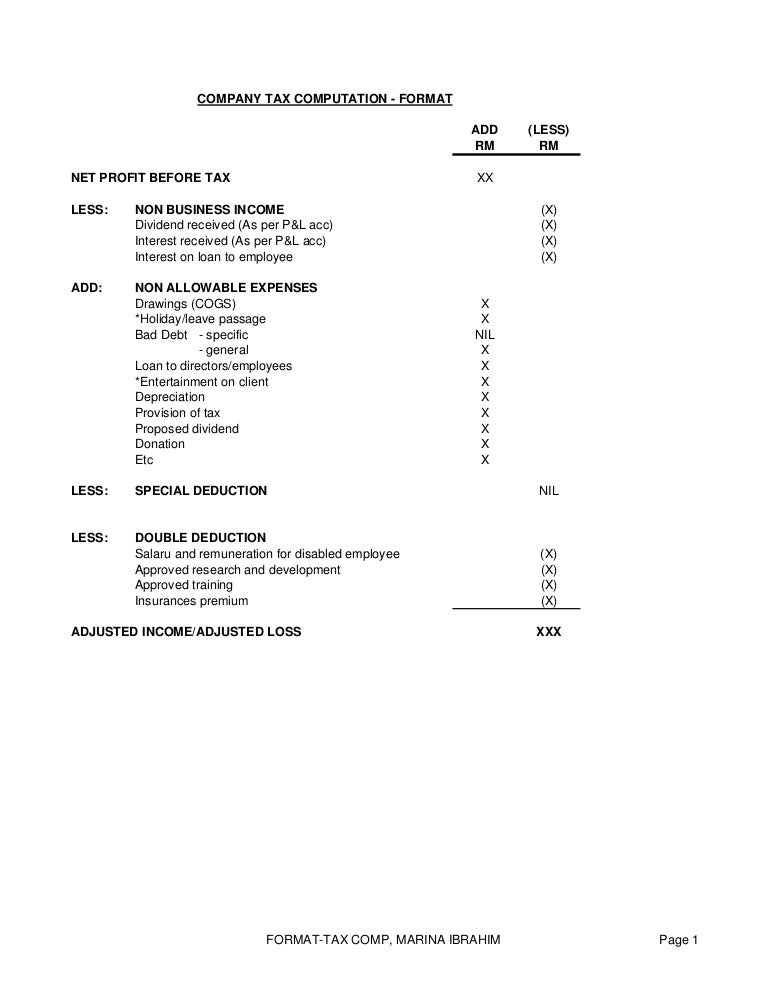

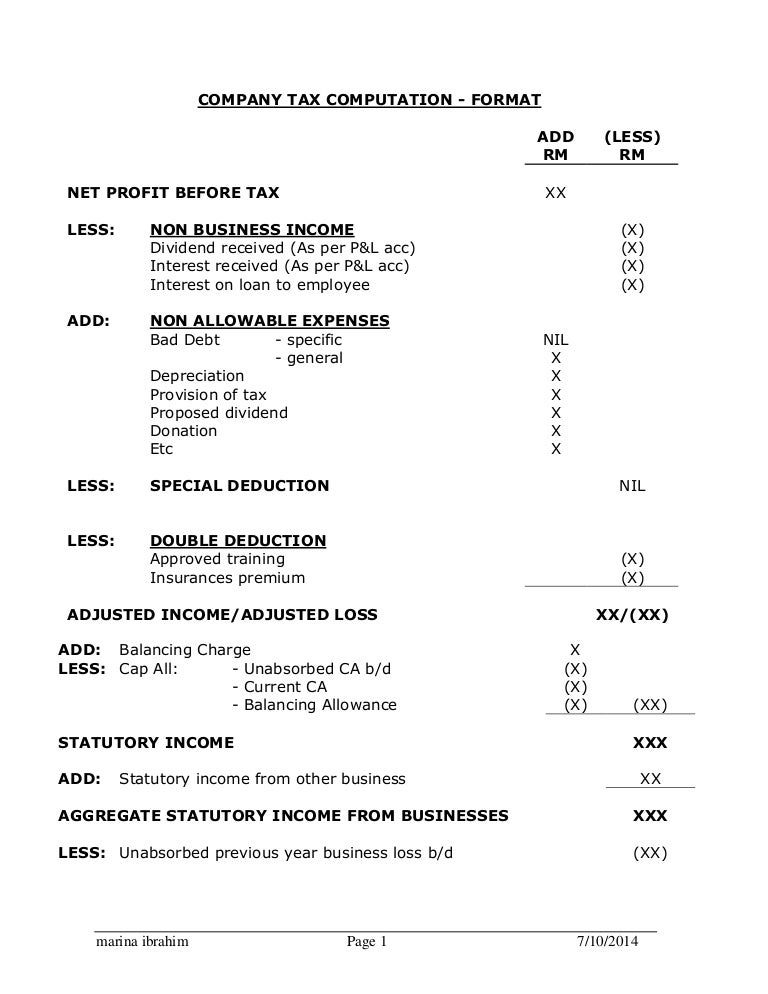

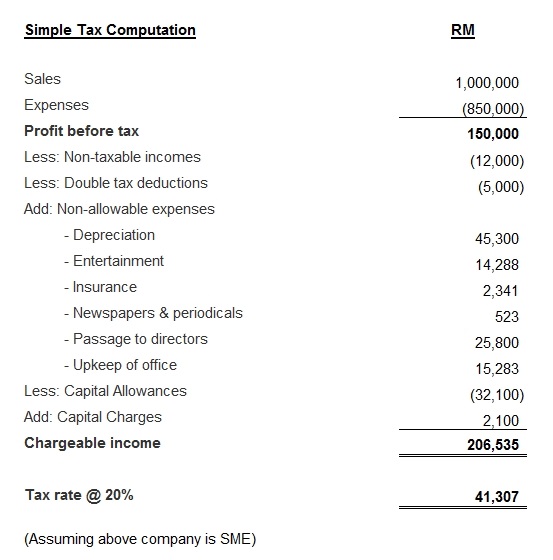

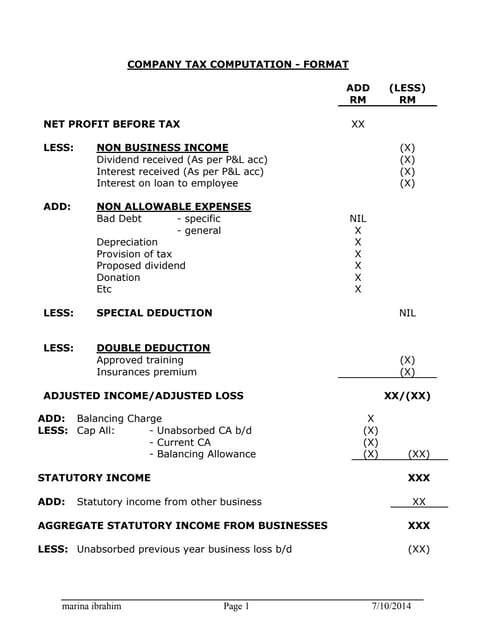

Company tax computation format malaysia 2020. On the first 2 500. Calculations rm rate tax rm 0 5 000. Examples of direct tax are income tax and real property gains tax. This booklet also incorporates in coloured italics the 2020 malaysian budget proposals announced on 11 october 2019 and the finance bill 2019.

For the be form resident individuals who do not carry on business the deadline for filing income tax in malaysia is 30 april 2020 for manual filing and 15 may 2020 via e filing. Resident company other than company described below 24. Melayu malay 简体中文 chinese simplified malaysia corporate income tax rate. These proposals will not become law until their enactment and may be amended in the course of their passage through.

The deadline for filing your income tax returns form in malaysia varies according to what type of form you are filing. With paid up capital of 2 5 million malaysian ringgit myr or less and gross income from business of not more than myr 50 million. For instance a manufacturing company with a pioneer status tax incentive pays an effective tax at the rate of 7 2 as only 30 of its profits are subject to tax. 2018 2019 malaysian tax booklet 7 scope of taxation income tax in malaysia is imposed on income accruing in or derived from malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope.

A company is required to furnish tax estimation form cp204 for the coming year to inland revenue board income tax department or lhdn within the first 3 months after the company has generated first sale. Some of the major tax incentives available in malaysia are the pioneer status ps investment tax allowance ita and reinvestment allowance ra. On the first 5 000 next 15 000. Malaysia adopts a territorial system of income taxation a company whether resident or not is assessable on income accrued in or derived from malaysia.

Income attributable to a labuan business. This page is also available in. A company with paid up capital less than rm2 5 million is required to submit form cp204 within the first year. Chargeable income myr cit rate for year of assessment 2019 2020.

The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn.