Service Type Code Sst

The services provided by the service provider from group g number 1 8 excludes the said services if provided in connection with.

Service type code sst. Service sector remain 6 from gst into sst in malaysia sst malaysia to impose 5 10 tax on goods and 6 on services 15 items exempted from sales and services tax sst. Business particulars field 5 7 32 figure 5 1. Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline. The service type indicates how the service is used by the system.

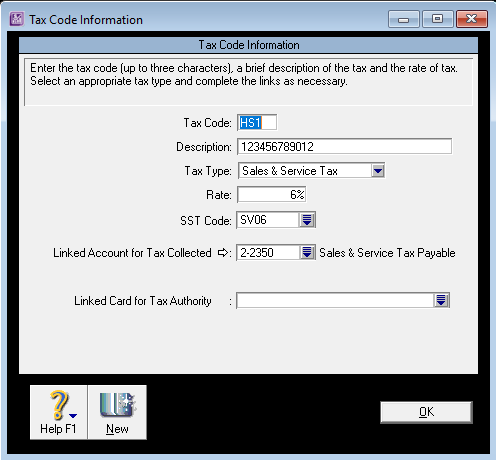

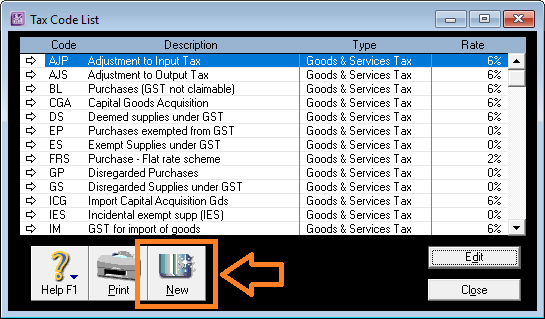

Harmonized commodity description coding system commonly known as hs codes and asean harmonized tariff nomenclature ahtn were created for international use by the custom department to classify commodities when they are being declared at the custom frontiers by exporters and importers. Service type code service tax regulation 6. This website is developed to enable the public to access information related to the royal malaysian customs department includes corporate information organization and customs related matters such as sales and service tax sst. Required to choose business type in field 4 as refer to figure 5 1 3.

The value of a servicetype instance represents a set of flags combined using the bitwise or operator. 4 sst sales and service license to view your sst license information and available tax schedule for submission. Service type code service tax regulation 4. The creation of interactive services is not supported.

The sst is a single stage of consumption tax while gst is a multi stage of consumption tax on goods and services that were levied at every stage of the supply chain. The servicecontroller that passes commands to the service stores a value for the service type. Service type code service tax regulation 5. Goods or land outside malaysia or where the subject matter relates to a country outside malaysia.

Figure 5 1 4 application sales tax. Tax return maintenance tax return draft to view your saved draft. Service type code service tax regulation 3.