Penalty For Late Submission Of Company Tax Return In Malaysia 2019

Failure to furnish estimate of tax payable.

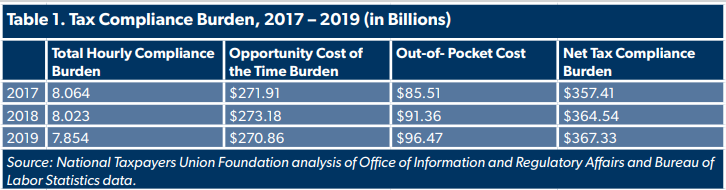

Penalty for late submission of company tax return in malaysia 2019. Thus the new deadline for filing your income tax returns in malaysia via e filing is 30 june 2020 for resident individuals who do not carry on a business and 30. The accounting period of a real estate investment trust reit ends on 31 may 2019. As per income tax act ita 1967 payment of income tax income tax has to be settle by the due date. Additional 5 on any unpaid tax and penalty that is outstanding after 60 days the additional 5 ceases w e f.

Up to 12 months 15 over 12 months up to 24 months 30 over 24 months 45. 112 1 200 to 2 000 or imprisonment or both. According to lembaga hasil dalam negeri lhdn the move is meant to facilitate the submission of tax returns affected by the national movement control order which starts today. 10 of tax payable.

Fail to furnish an income tax return form. Late payment of tax instalment. The guidelines includes that the penalty rates depending on the extent of the delay from the return deadline as follows under the income tax act. For individual with employment no business income the dateline is 30th april while individual with business income the dateline is 30th june.

Penalty will be imposed for any payment made after the due date. Additional 5 increment on the balance of a if payment is not made after 60 days from the final date. Make an incorrect tax return by omitting or understating any income. Kuala lumpur feb 28.

112 1 200 to 2 000 or imprisonment or both. 10 of outstanding tax instalment amount. Aside from having to pay more if you re late to submit your tax form you will get fined if you understated your taxes don t submit a form at all or for various other offences. Underestimation of tax estimate for a ya by more than 30 of actual tax payable.

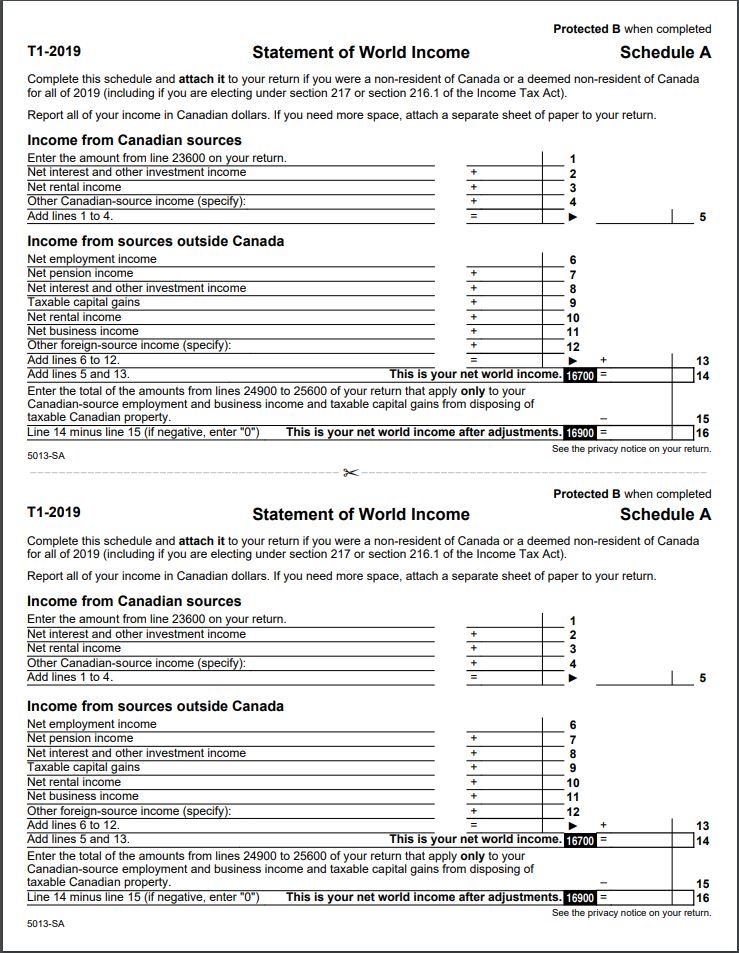

Under section 120 1 f of the income tax act 1967 ita any company which without reasonable excuse fails to submit the estimate of tax payable for a year of assessment shall be guilty of an offence and upon conviction be liable to a fine ranging from rm200 to rm2 000 or face imprisonment for a term not exceeding 6 months or both. The income tax return forms itrf for year of assessment 2019 for forms e be b p bt m mt tf and tp can be submitted starting from march 1 2020 via e filing in a statement today the inland revenue board of malaysia irbm said taxpayers are encouraged to furnish their itrf and pay the income tax within the stipulated period to avoid imposition of late penalty. Pay taxes after 30th june. The due date for submission of the reit s rf form tr for year of assessment 2019 is 31 december 2019.