Non Allowable Expenses In Taxation Malaysia

The statutory body who is in charged with the direct tax is the malaysia inland revenue board lhdn.

Non allowable expenses in taxation malaysia. To the special commissioners of income tax and the courts. Interest royalty contract payment technical fee rental of movable property payment to a non resident public entertainer or other payments made to non residents which are subject to malaysian withholding tax but where the withholding tax was not paid. A direct tax is a tax that is levied on a person or company s income and wealth. For deductibility of interest expense in a cross border controlled transaction earnings stripping rules may apply.

See the group taxation section for details. To get a copy of income tax return form from the nearest lhndm branch if the form does not reach on time. 6 5 legal expense incurred by a landlord when a property is let for the first time by the owner or lessor. 6 4 income tax returns a cost of filing of tax returns and tax computations.

Double deduction expenses allowable under income tax act 1967. Examples of direct tax are income tax and real property gains tax. Where a borrowing is partly used to finance non business operations the proportion of interest expense will be allowed against the non business income. B cost of appeal against income tax assessment i e.

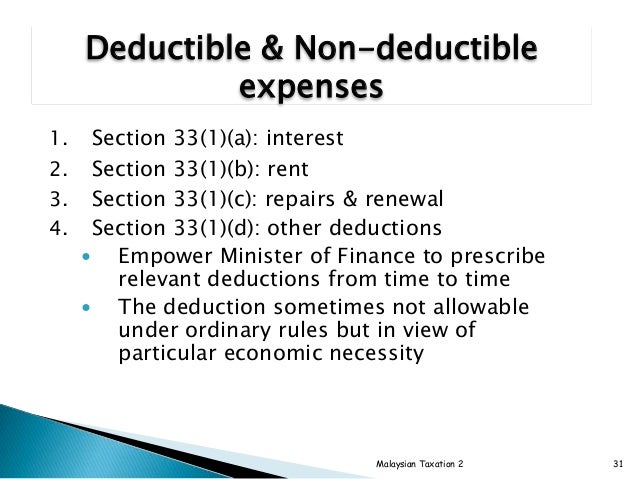

Tax deductions from gross income section 33 by tan thai soon section 33 1 the adjusted income of a person from a source for the basis period by deducting from the gross income of that person from that source for that period all out goings and expenses wholly and exclusively incurred during that period by that person in the production of gross income from that source including.