Malaysia Personal Income Tax Rate

With effect from ya 2020 a non resident individual is taxed at a flat rate of 30 on total taxable income.

Malaysia personal income tax rate. For example let s say your annual taxable income is rm48 000. Average lending rate bank negara malaysia schedule section 140b restriction on deductibility of interest section 140c income tax act 1967 study group on asian tax administration and research sgatar. Personal income tax rate in malaysia averaged 27 29 percent from 2004 until 2020 reaching an all time high of 30 percent in 2020 and a record low of 25 percent in 2015. The personal income tax rate in malaysia stands at 30 percent.

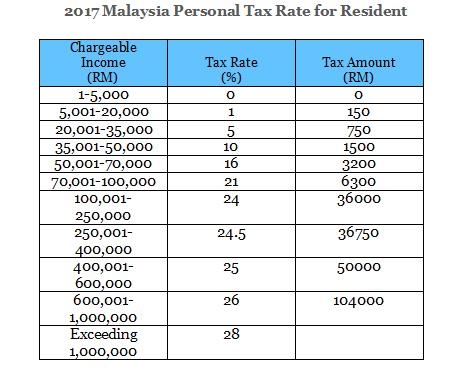

Malaysia personal income tax rate. Below are the individual personal income tax rates for the year of assessment 2019 provided by the the inland revenue board irb lembaga hasil dalam negeri lhdn malaysia. A qualified knowledge worker in a specified area currently only iskandar malaysia is taxed at the concessionary rate of 15 on chargeable income from employment with a designated company engaged in a qualified activity e g. Based on this amount the income tax to pay the government is rm1 640 at a rate of 8.

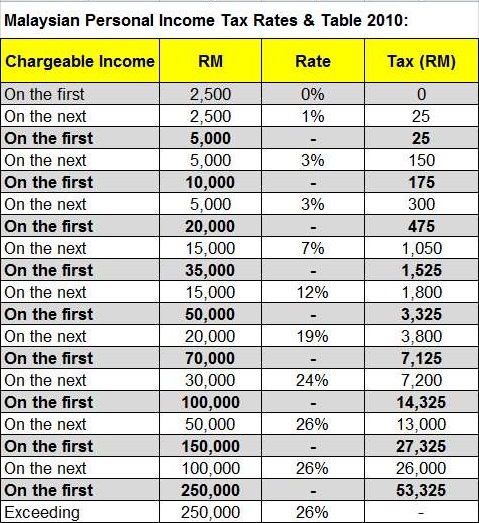

A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first rm5 000 to a maximum of 30 on chargeable income exceeding rm2 000 000 with effect from ya 2020. This page provides malaysia personal income tax rate actual values historical data forecast chart statistics economic calendar and news. Personal income tax rates. Here are the income tax rates for personal income tax in malaysia for ya 2019.

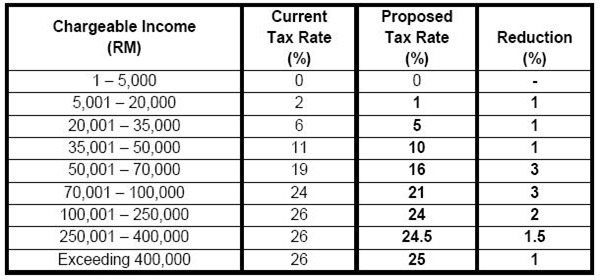

The personal income tax rates for 2018 2019 have been restructured and are different from previous year s rates. However if you claimed rm13 500 in tax deductions and tax reliefs your chargeable income would reduce to rm34 500. Non resident individuals pay tax at a flat rate of 30 with effect from ya 2020. Box 10192 50706 kuala lumpur malaysia tel.

Income tax rates 2020 malaysia.