Lhdn 2019 Tax Rate

Lembaga hasil dalam negeri tax relief history.

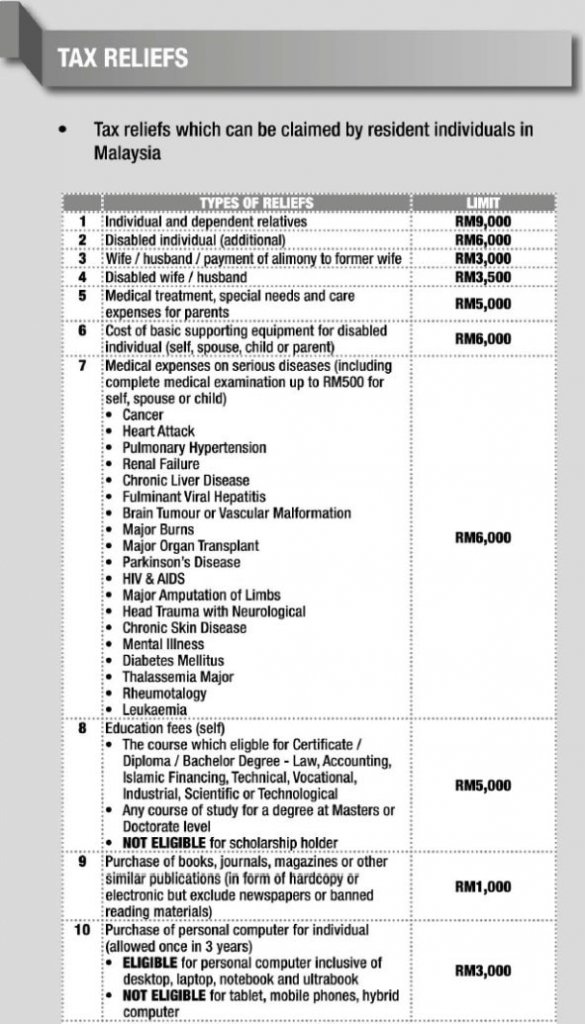

Lhdn 2019 tax rate. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Any individual earning more than rm34 000 per annum or roughly rm2 833 33 per month after epf deductions has to register a tax file. On the first 5 000 next 15 000. Pengiraan rm kadar cukai rm 0 5 000.

Pengiraan rm kadar cukai rm 0 5 000. Income tax rates 2020 malaysia. On the first 2 500. Tax administration diagnostic assessment tool tadat.

Ringgitplus how to maximize income tax refund 2019. Comparehero 7 tax exemptions in malaysia to know about. What is a tax deduction. Return form rf filing programme for the year 2020.

2019 05 30 14 53 56 ibu pejabat lembaga hasil dalam negeri malaysia menara hasil persiaran rimba permai cyber 8 63000 cyberjaya selangor. Return form rf filing programme for the year 2020 amendment 1 2020 return form rf filing programme for the year 2020 amendment 2 2020. Calculations rm rate tax rm 0 5 000. Ringgitplus malaysia personal income tax guide 2020.

For example if you are single and your taxable income was 50 000 in 2019 9 700 will be taxed at 10 income from 9 701 to 39 475 will be taxed at 12 and the rest will be taxed at 22. 5 000 pertama 15 000 berikutnya. Imoney income tax relief for ya 2018. Tahun taksiran 2018 2019.

Lembaga hasil dalam negeri malaysia tidak bertanggungjawab terhadap sebarang kehilangan atau kerosakan yang dialami kerana menggunakan maklumat dalam laman ini.