Input Tax Credit Under Gst Ppt 2019

Gst itc ppt input tax credit under gst gst itc ppt gst itc ppt.

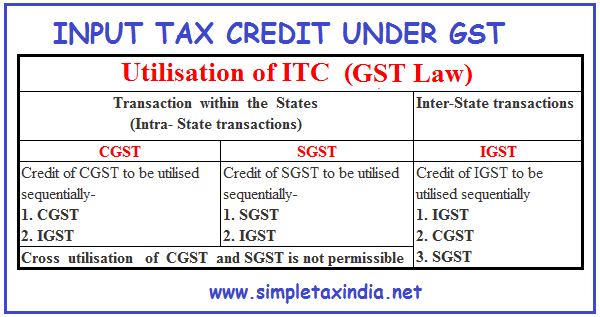

Input tax credit under gst ppt 2019. The wrong claim of input tax credit may attract penal tax interest and penalty. 4 input tax credit to be availed by a registered person in respect of invoices or debit notes the details of which have not been uploaded by the suppliers under sub section 1 of section 37 shall not exceed 20 per cent. Gst is nothing but a value added tax on goods services combined. With the said introduction various provisions of the cgst act 2017 has under gone amendments and one of such amendment relates to blocked credit on motor vehicles which have been taken up in the present article.

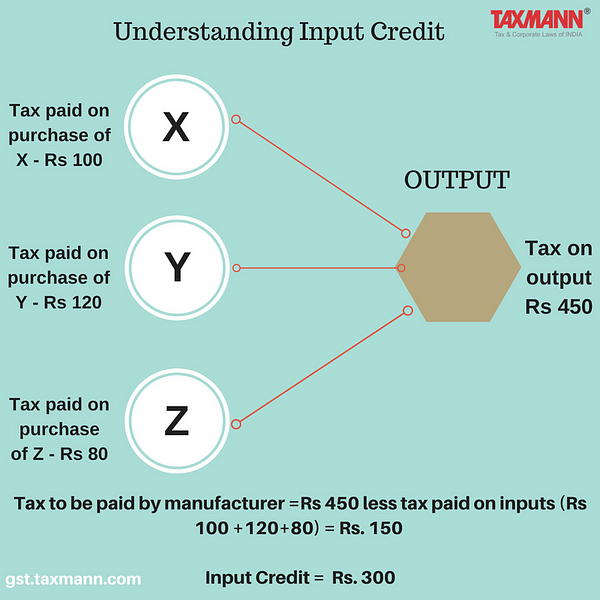

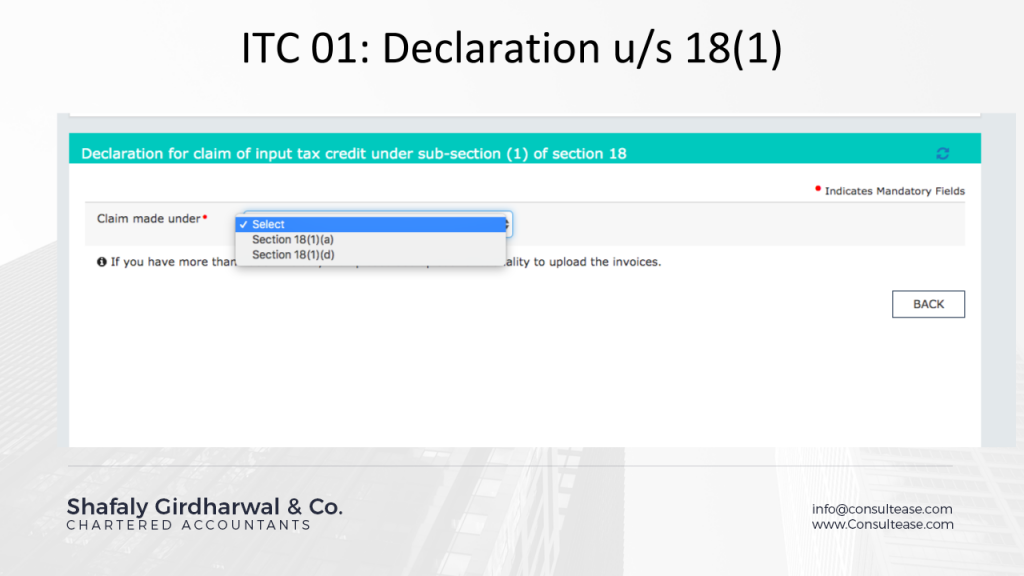

Ppt on all input tax credit forms in gst. Since garv had paid gst on inputs he can claim an input tax credit of an amount equal to the gst paid on the inputs i e. 2 the amount of input tax credit referred to in sub rule 1 shall be added to the output tax liability of the registered person for the month in which the details are furnished. On 20th march 2019 their turnover crossed the threshold limit of rs.

And the amount of input tax credit availed of in form gstr 2 for the month immediately following the period of 180 days from the date of issue of invoice. Filing of return under section 27 for the month of september following the end of financial year to with such. Of the eligible credit available in respect of invoices or debit notes the details of which have been uploaded by the suppliers under sub section 1 of section 37. They will be eligible to claim the itc on the stock of inputs and inputs contained in stock of semi finished and finished goods as on 19th march.

Dell internal use confidential restrictions for claiming credit time limit for claiming credit a taxable person shall not be entitled to take input tax credit in respect of any supply after the earlier of following two events 1. Similarly when garv sells goods to ananya he collects rs 45 000 as gst from garv. 503 tower hibiscus paramount floraville sector 137 noida 201304 91 9818156768 email. Input tax credit is available on each supply made under gst subject to conditions prescribed.

The balance rs 3 600 is paid to the govt. They applied for registration on 30th march and duly granted the registration. Input tax credit itc is the backbone of the gst regime. It is a very important topic for the registered person to understand how he can claim input tax credit when he can claim which he cannot claim etc.

02 2019 central tax dated 29th january 2019 the central goods and service tax amendment act 2018 has been made effective from 1 st february 2019. Narayan lodha chartered accountantprivileged and confidential goods and services tax gst in india a presentation by ca narayan lodha chartered accountant flat no.