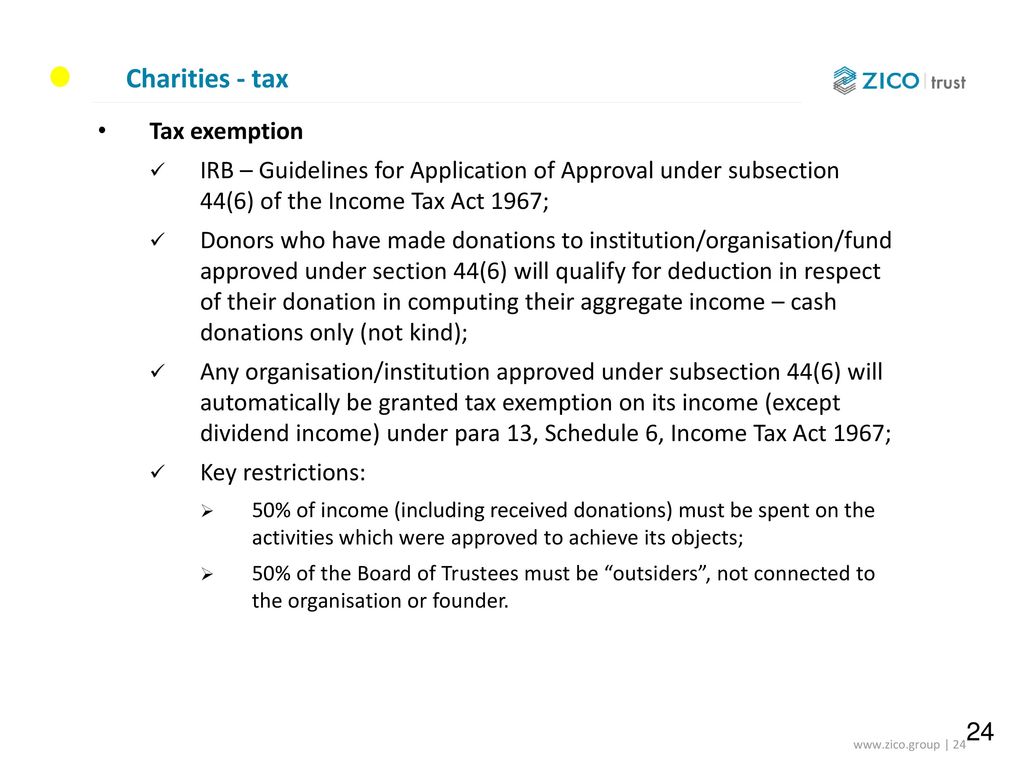

Income Tax Act 1967 Section 44 6

Guidelines for application of approval under subsection 44 6 of the income tax act 1967.

Income tax act 1967 section 44 6. These guidelines serve to explain the types of institutions organisations or funds which may be considered for approval under subsection 44 6 of the income tax act 1967 and the various steps procedures involved in the. Subsection 44 6 of the income tax act 1967 1. These guidelines serve to explain the types of institutions organisations or funds which may be considered for approval under subsection 44 6 of the income tax 1967 and the various steps procedures involved in the submission of application for approval and the other related matters. Subsection 6 amended by act 608 of 2000 s8 a i by substituting for the full stop at the end of the subsection a colon with effect from year of assessment 2001.

One of the criteria to qualify for approval under subsection 44 6 of the income tax act 1967 ita is that more than 50 of the members of the bot bod cm must consist of outsiders who are not related to the institution organization and founder. Provided that the amount to be deducted from the aggregate income for the relevant year in respect of any gift of money made to any institution or organization approved for the purposes of this section by the director general shall not exceed. 1 2 these guidelines explain i. Introduction 1 1 the purpose of this guideline is to replace the guidelines for application of approval under subsection 44 6 of the income tax act 1967 ita 1967 issued in january 2005.

The types of institution or organisation eligible to apply for.