How To Pay Income Tax Online Canada

Choose the type of payment you want to make.

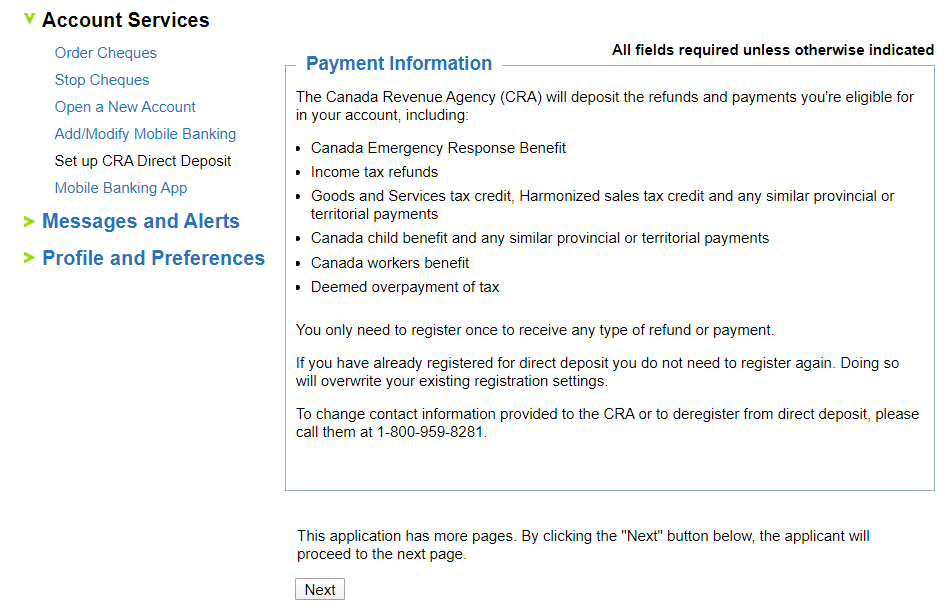

How to pay income tax online canada. Select add payee to add a canadian payee to your payee list. You can also request a payment plan online. Services and information that can help you meet your payment obligations. Benefits and credits repayments.

Set it and forget it so no more late fees. Pay your taxes now. The deadline to pay 2019 income taxes was july 15. When you owe money collections at the cra.

Select pay canadian bills. The fee is based on the total amount of the duties and taxes advanced and will be billed to the party designated to pay the duties and taxes. Individual income tax t1 including instalments and amount owing. You can also pay your taxes with a debit card from a canadian banking institution.

The fastest and easiest way to pay your taxes is. You can mail a check pay using online or telephone banking use the cra s my payment serviceor pay at a canadian financial institution. Options for paying taxes online in person or using a third party service provider. Part xiii non resident withholding tax.

Selecting a payment method 1. If you suspended installment agreement payments during the relief period you must resume payments due after july 15. Payment for the balance owing on line 485 of your tax return is due by april 30 of the year following the tax year. You can make a payment with your credit card by using a third party service provider.

Fedex express pays the duties and taxes owed to the canada border services agency on your behalf and charges the advancement fee for this service. Pay by credit card. Go in person to a canada. Pay your taxes through online banking for a quick and easy option.

With pre authorized debit the money you owe is automatically deducted from your account. Use your debit card to pay online. Select pay bills from the left menu.

/https://www.thestar.com/content/dam/thestar/business/2014/04/09/canada_revenue_agency_shuts_down_online_services_over_security_fears/cra.jpg)