Gst Start Date In Malaysia

Currently we are sst to be reintroduced at 10 and service tax at 6 starting september 1 world of buzz.

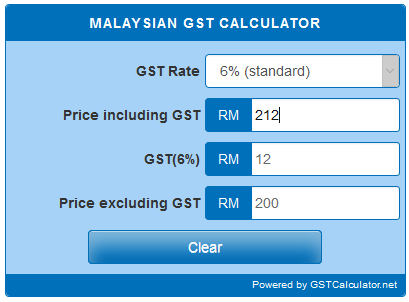

Gst start date in malaysia. Malaysia is the second country in south east asia to introduce such a tax along with singapore. For more information regarding the change and guide please refer to. Gst was replaced with the sales tax and service tax starting 1 september 2018. It was reduced to 0 on 1 june 2018.

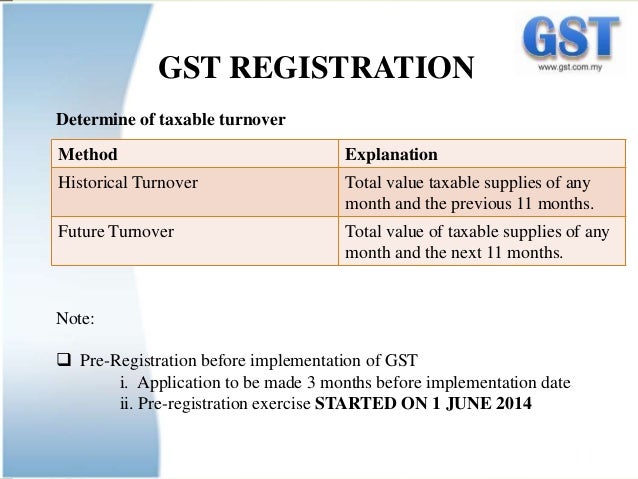

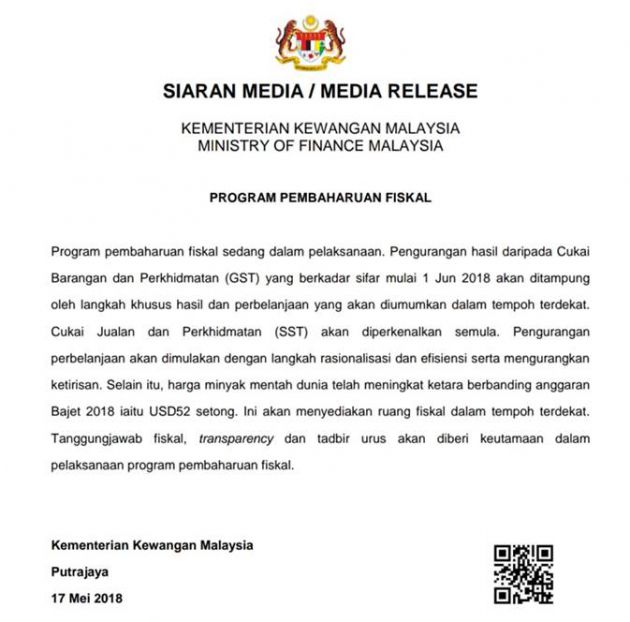

Although no firm date has been set dr mahathir has stated that sst will be implemented in september 2018. Malaysia digital service tax extended to supplies from foreign digital service providers on january 1 2020. Overview of goods and services tax gst in malaysia. The ministry of finance mof announced that sales and service tax sst which administered by the royal malaysian customs department rmcd will come into effect in malaysia on 1 september 2018.

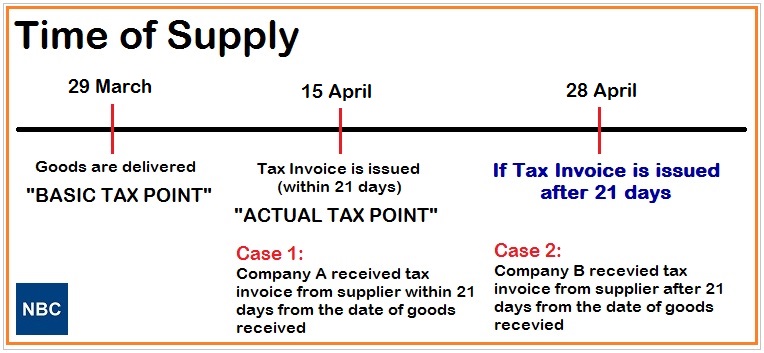

Column 5 b is meant for declaration of gst due and payable for the period of april to may. The government of malaysia tabled for first reading the bill to repeal gst in parliament on 31 july 2018 dewan rakyat. You must make a declaration of 6 standard rated sales before 01 june 2018 and 0 standard rated sales from 01 june 2018 in column 5 a of gst 03. The goods and services tax gst in malaysia had been reduced to zero since june 1 2018 and malaysians were rejoicing as the prices of goods were lowered following this new ruling.

The ministry of finance mof announced that starting from 1 june 2018 the rate of the goods and service tax gst will be reduced to 0 from the current 6. Malaysia digital service tax rules at a rate of 6 brought foreign suppliers of digital services into scope from the start of 2020. Goods and services tax lebih dikenali dengan akronim gst merupakan cukai nilai tambah yang telah dimansuhkan di malaysia setiap pihak kecuali pengguna akhir dalam rantaian bekalan layak menuntut semula kredit cukai input. Cukai barang dan perkhidmatan bahasa inggeris.

The move of scrapping the 6 gst has paved the way for the re introduction of sst 2 0 which will come into effect in 1 september 2018. Following the reintroduction of sales and services tax sst in malaysia replacing the 6 goods and services tax the customs department has issued further guidance on returns. Until then a transitional arrangement will be in place to help businesses acclimate to the new environment. Form sst 02 should be used.

Malaysia gst reduced to zero.