Form P Partnership Malaysia

A copy 1 form q or form k from lembaga penilai pentaksir ejen hartanah malaysia if relevant or.

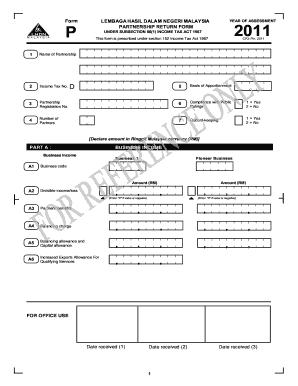

Form p partnership malaysia. Inland revenue board of malaysia shall not be liable for any loss or damage caused by the usage of any information obtained from this website. A copy 1 an akcnowledgement letter from mia if relevant and a copy 1 appointment letter as a tax agent if the registration commit by the tax agent. Cp30 shows distribution of income profit loss to each partner. While a partnership does not pay tax it still has to file an annual income tax return called the form p to show all income earned and business expenses deducted by the partnership during the year.

Refer to appendix f of the form p guidebook for the list of countries which have avoidance of double taxation agreements with malaysia. The partnership is also meant to create a political collaboration and election cooperation especially in the context of the sabah state election. The registration of a local business can be completed at any of the ssm offices but investors also have the option of registering it using an online portal the ezbiz online services. By mt webmaster on sep 19 2020.

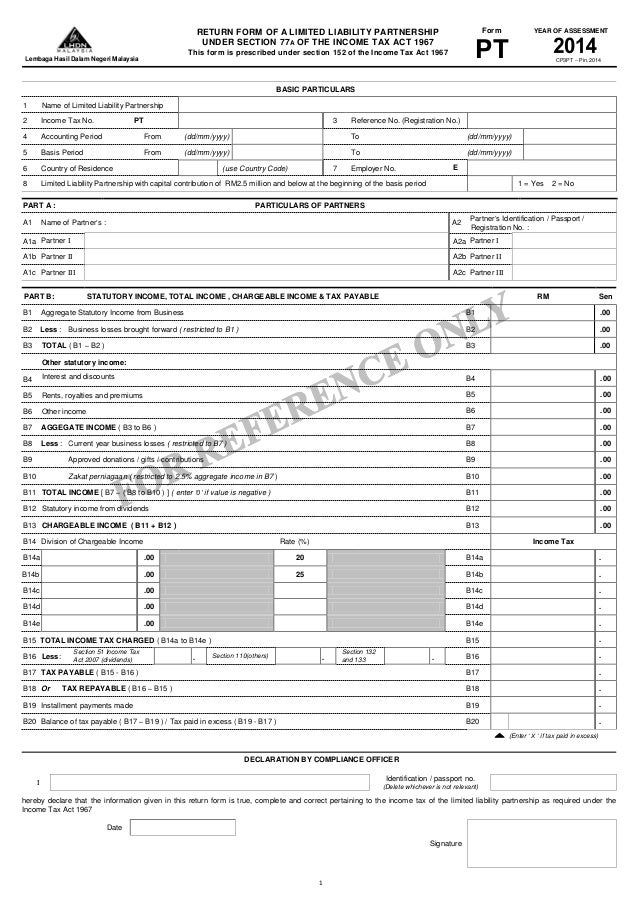

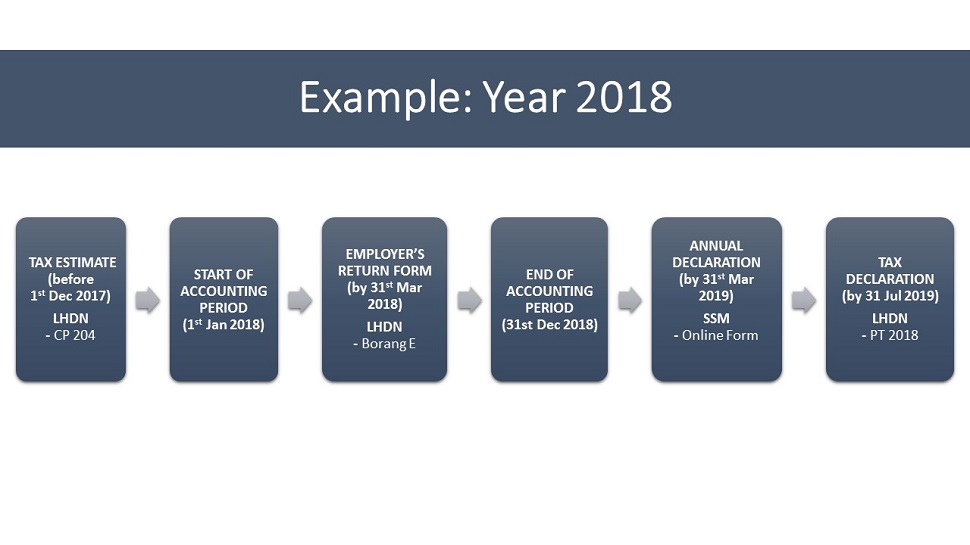

Mmo parti bersatu sabah pbs has signed a partnership with perikatan nasional pn to seal a formal political affiliation in government. The form cp30 has to be provided to each partner so as to enable them to declare their partnership income within the stipulated period. The partnership could file form p through paper form submission or e filling. Form p e p partnership return form.

The deadline for filing form p is 30 june. Year of assessmentform cp3 pin. Additional information on partnership the precedent partner is responsible for filling up form p and issuing form cp30 to each and every partner cp30 form. 133 tax deduction in respect of income brought into malaysia on which tax has been charged in malaysia and in the country of origin.

A partnership in malaysia is a type of business which requires at least two partners and up to 20 which should be registered with the ssm by following the above mentioned rules. However the signing does not make pbs a member of pn but rather a partner rakan sekutu in both the political associations and in the federal government. Lhdnm has to be notified in writing in case of any amendment to the form p already submitted. Every partner has to report his share of partnership income in his form b.

Form m mt e m e mt return form of a non resident individual knowledge worker. Use working sheet hk 8a of the form p guidebook.