Debit Note And Credit Note

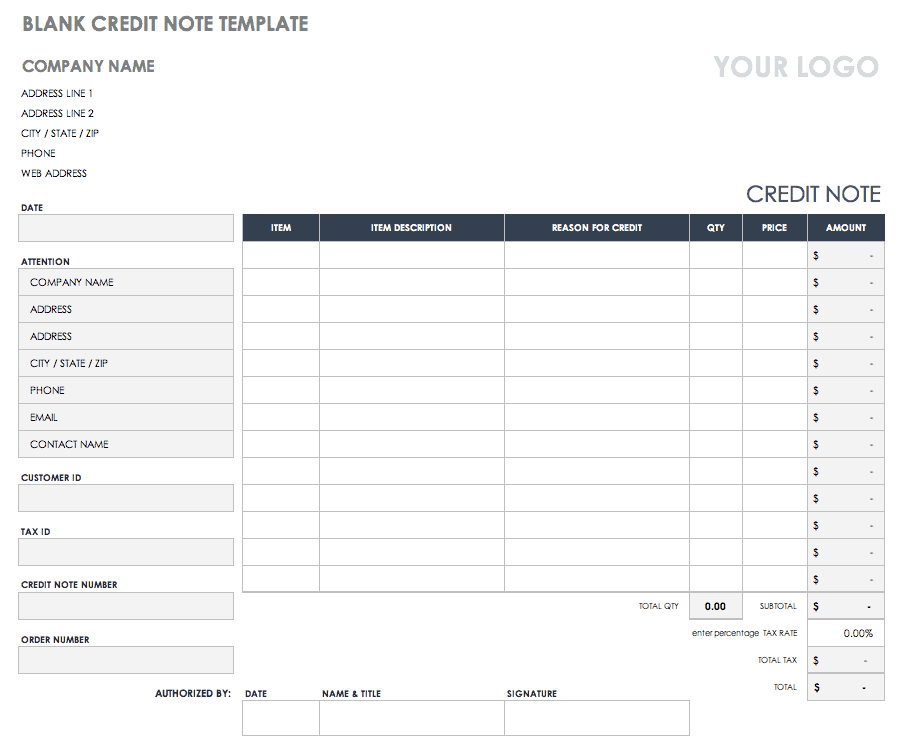

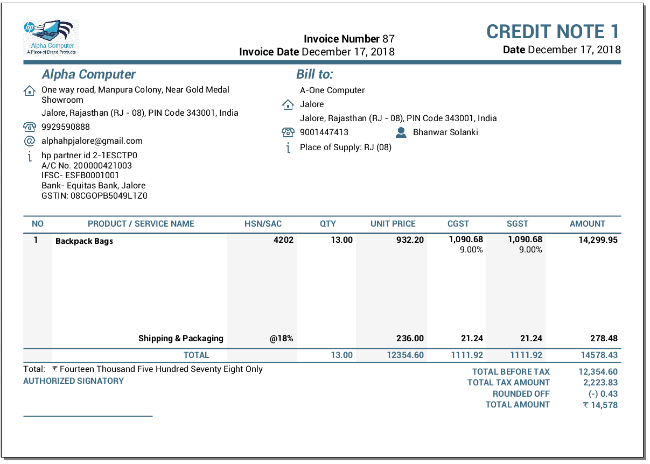

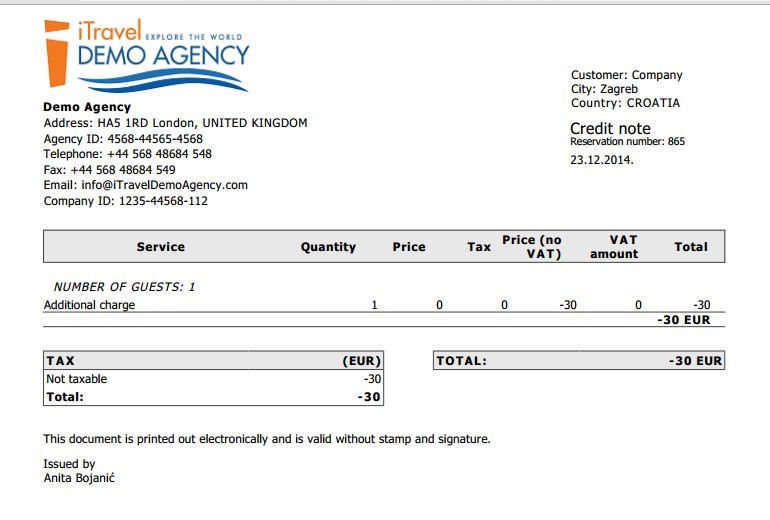

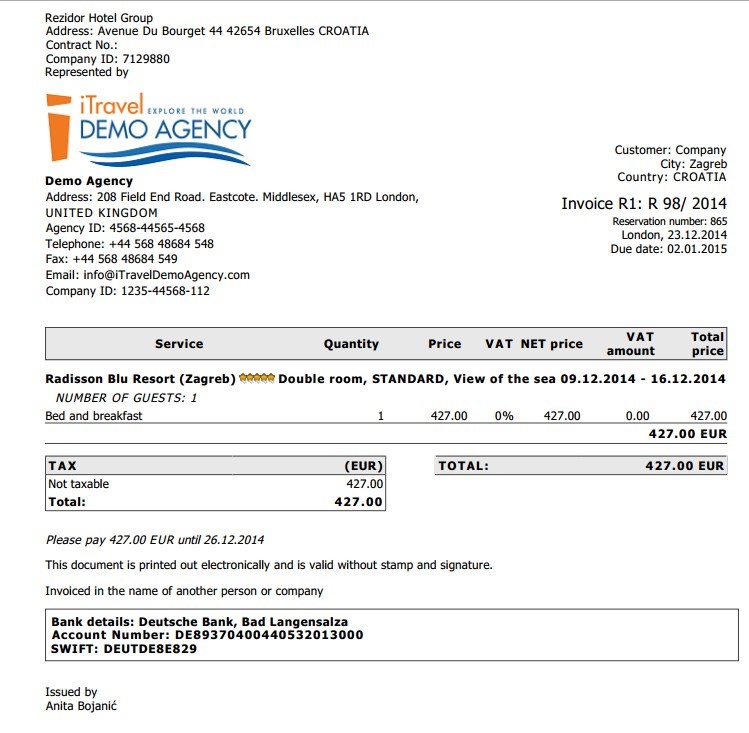

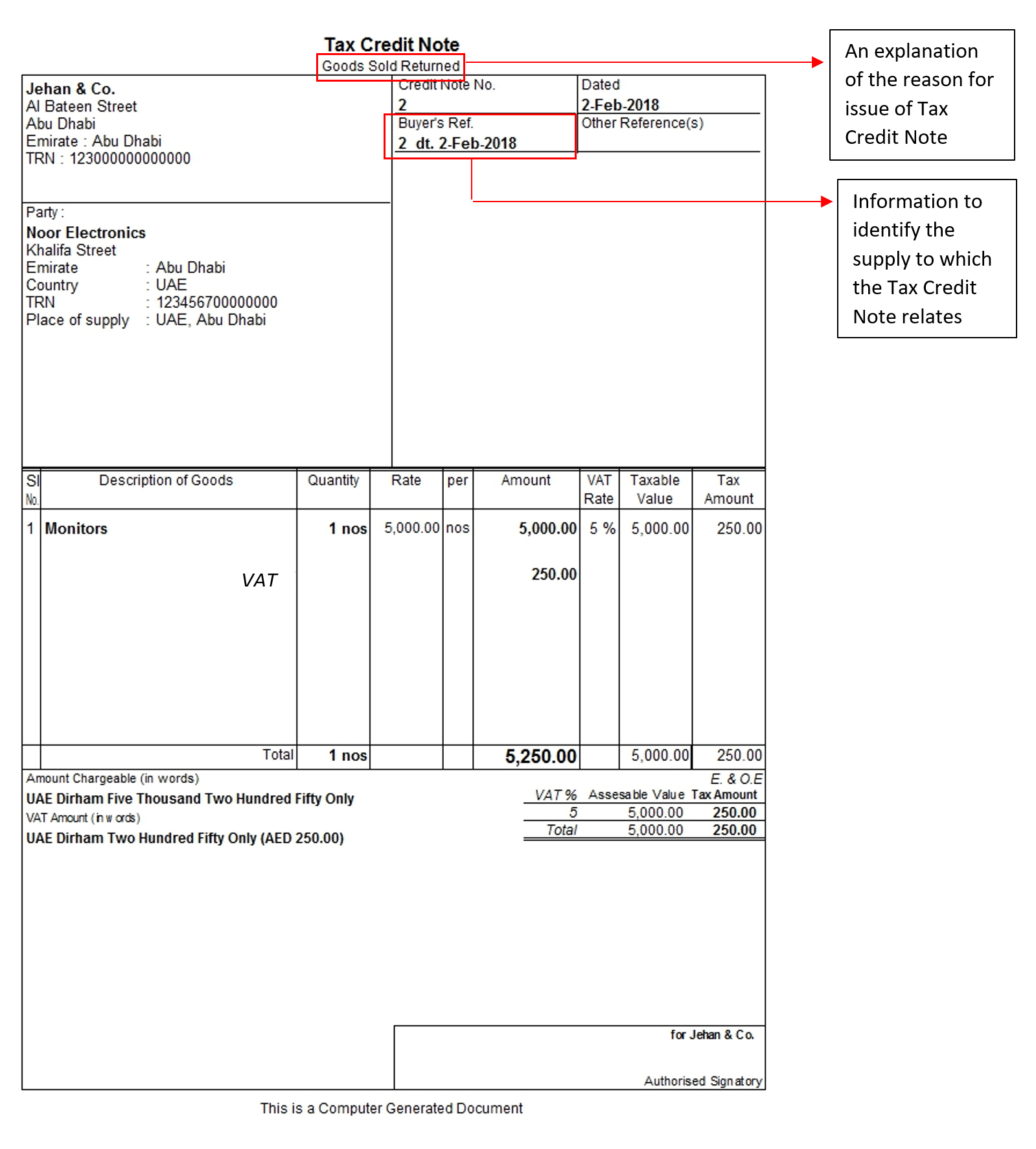

Thus a credit note may be defined as a document sent by the seller to a customer showing that the customer s account has been credited with the amount shown.

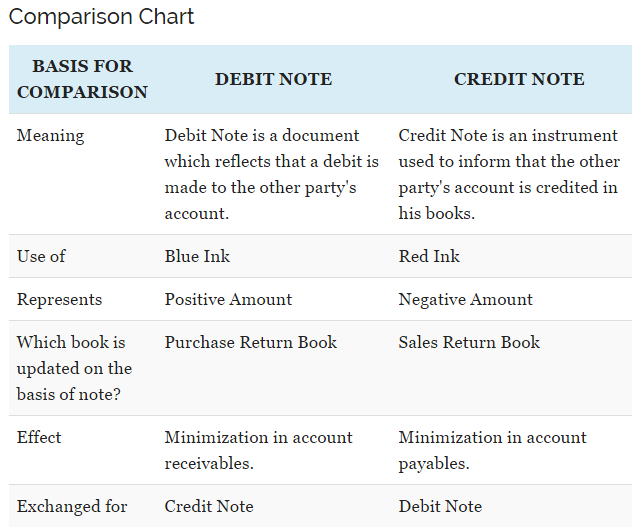

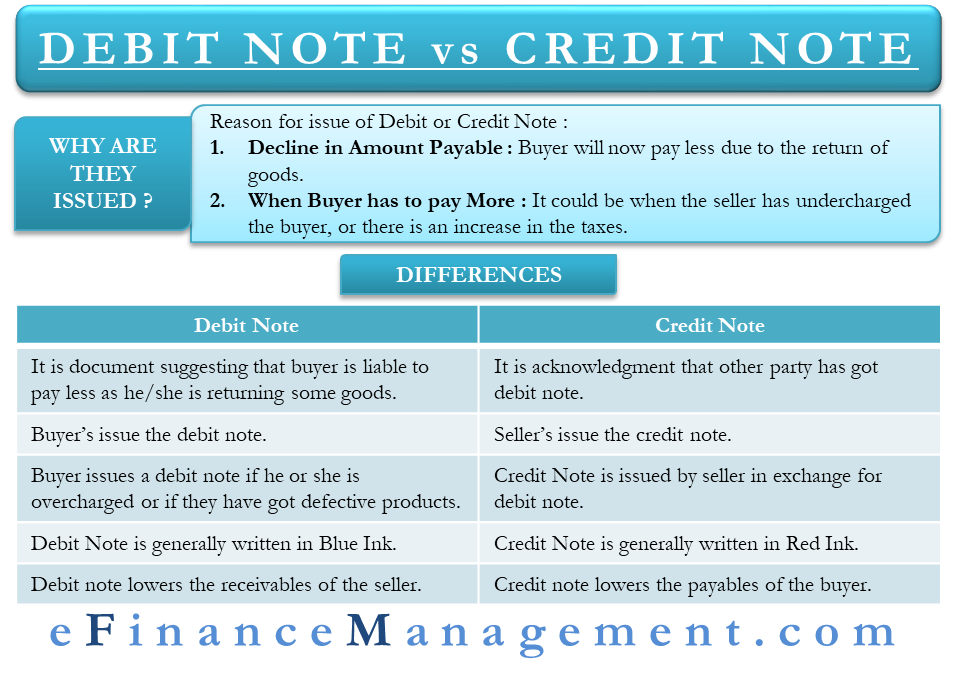

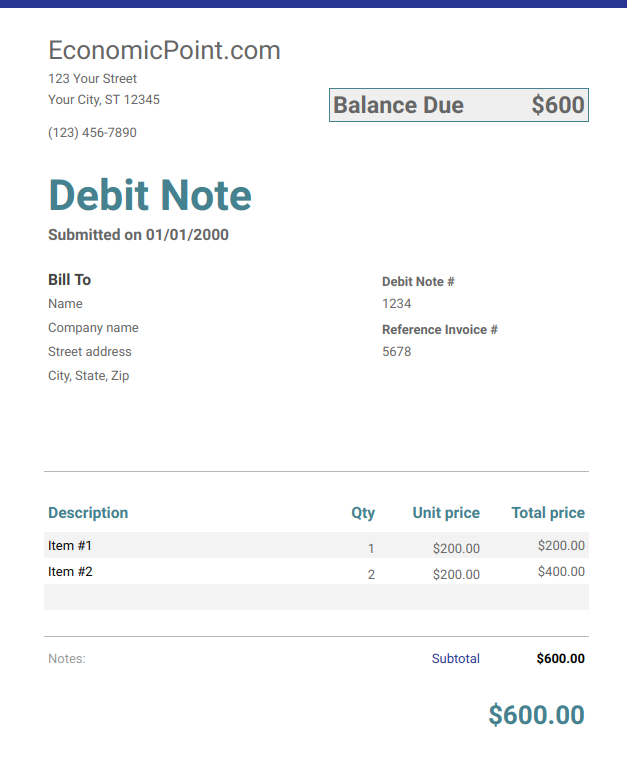

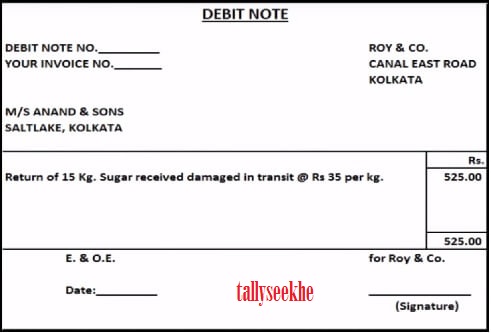

Debit note and credit note. Debit note is an accountingdocument issued by a buyer to a seller stating that the seller s account has been. The following are the differences between debit note and credit note. Accounts payable management and accounts receivable management include dealing with credit and debit notes on a daily basis. Debit note is prepared and issued by a buyer or customer who intends to return goods.

Debit note is written in blue ink while credit note is prepared in red ink. It is important to present a debit or a credit note as per gst law and the registered party must issue this document. A memo sent by one party to inform the other party that a debit has been made to the seller s account in buyer s books. Debit note is an official articulated form of purchase return.

All amount entered in a credit note must be negative likewise in a debit note it must be positive. Debit and credit notes are an important part of today s business culture as corporations have grown large and so have their credit sales and purchases. From the above format of the credit note you will notice that it is nothing but a mirror image of a debit note. In the same manner a credit note is also an official etched out written format of stating sales return.

A debit note or a credit note can be issued in 2 situations when the amount payable by buyer to seller decreases there can be a change in the value of goods after the goods are delivered and invoice is issued by the seller. So that was all about debit note and credit note. Debit note is issued in. Prepared and issued by.