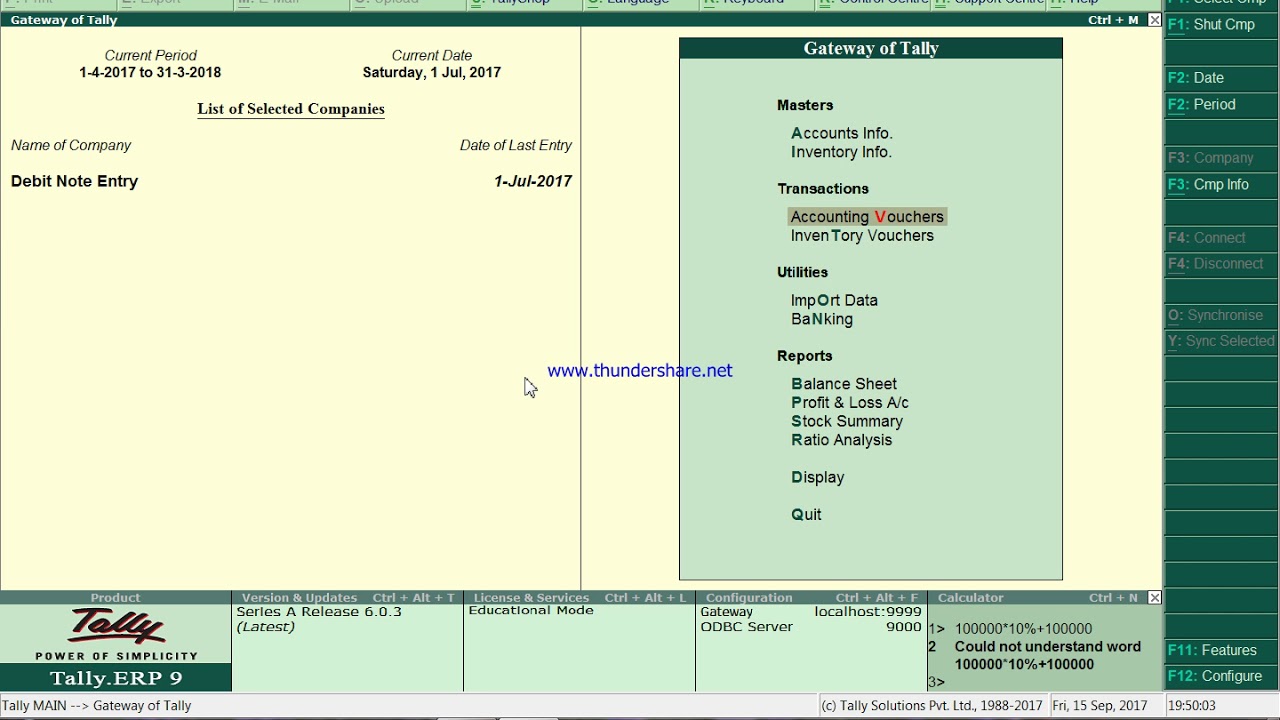

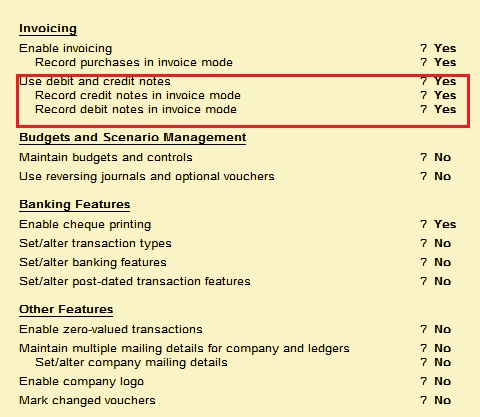

Debit Note And Credit Note Entry With Gst

This video explains how to fill details of debit credit notes in gstr 1 return this video is clearly explained in simple english by ca bhavishyasri.

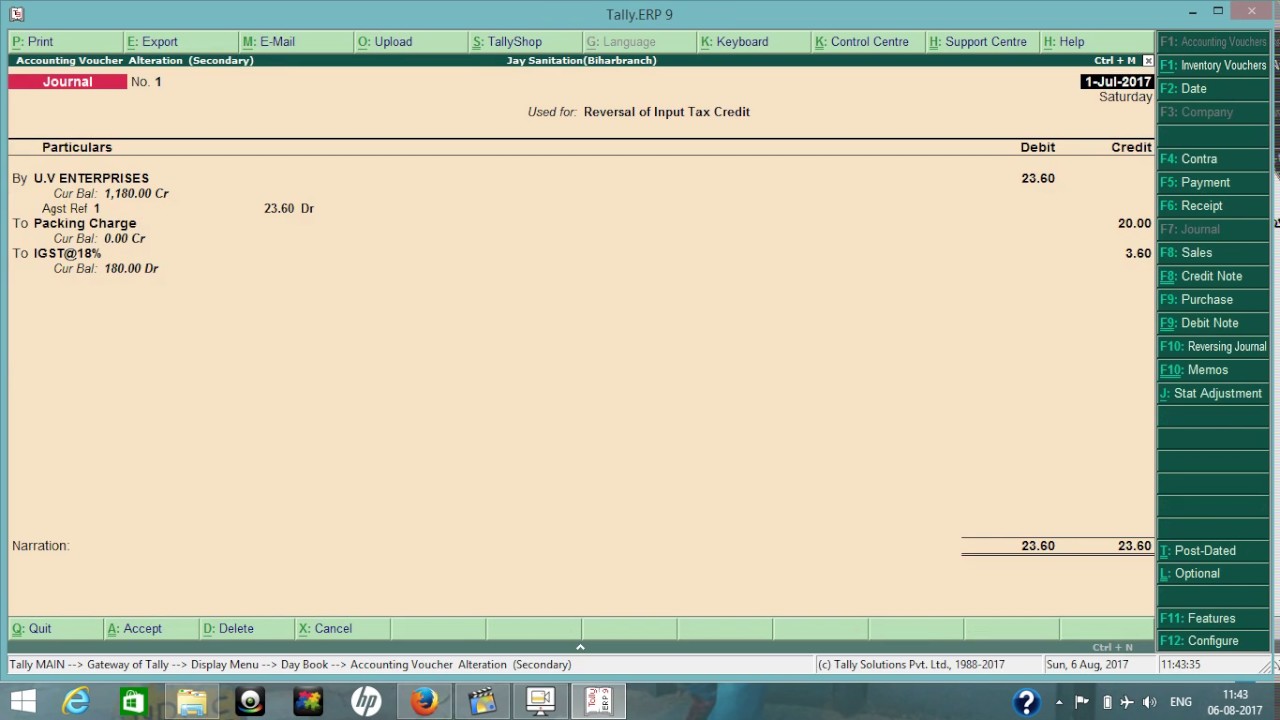

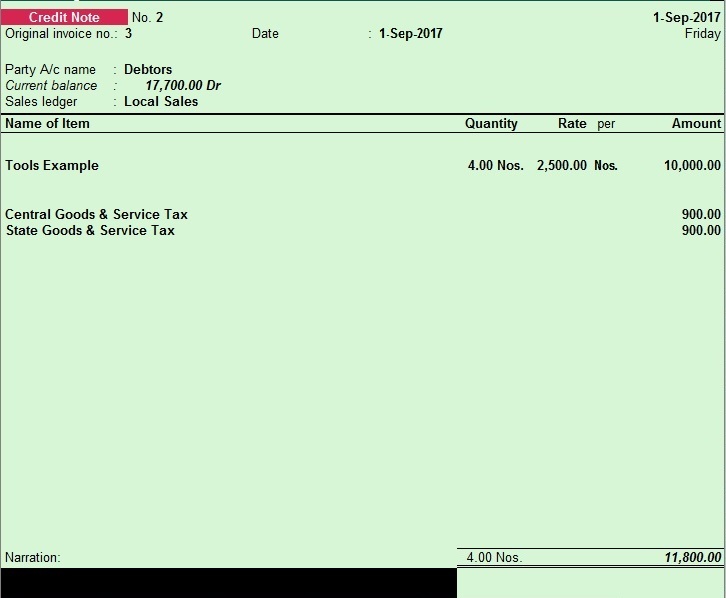

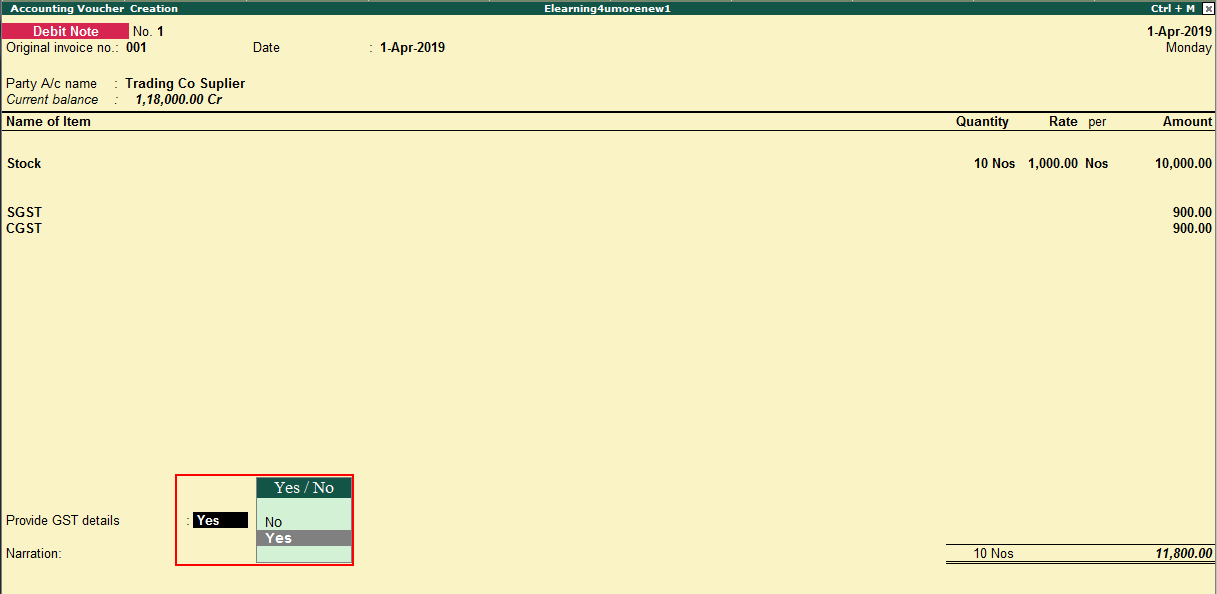

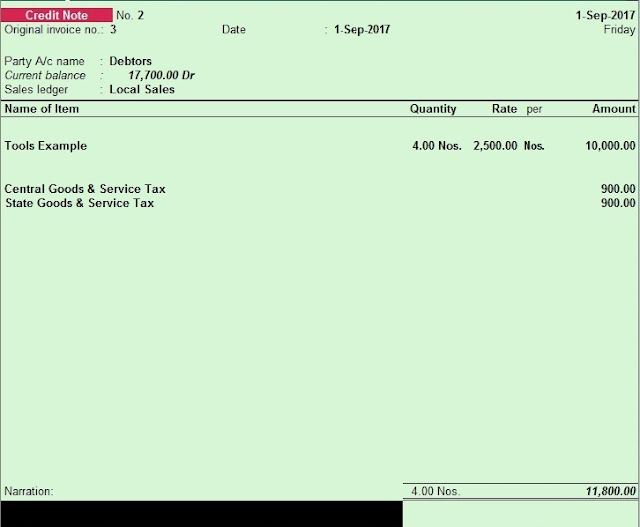

Debit note and credit note entry with gst. However such a debit note has no relevance under gst. A credit note and debit note for the purpose of gst law can be issued by the registered person who has issued the tax invoice i e. The details of the debit note credit to be declared in form gstr 1 shall be given along with details of original invoice number date and gstin. In case the supplier fails to show the details of such documents in the valid returns the recipient needs to declare the same in his valid returns.

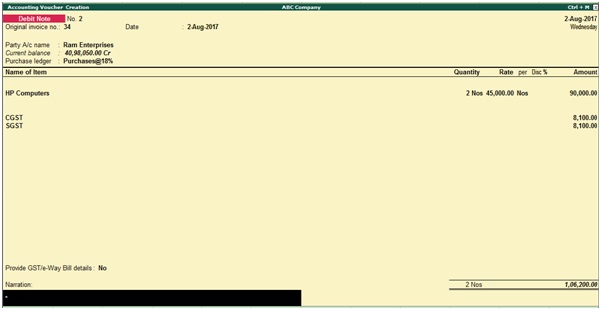

Example abc company sold goods worth of rs 50 000 to xyz company after checking the goods xyz company has returned damaged goods worth of rs 20 000 to abc company. The debit note credit note must contain the invoice number of the original supplies made. Any such document by whatever name called when issued by the recipient to the registered supplier is not a document recognized under the gst law. A debit and credit note for the purpose of the gst law can be issued by the registered person who has issued a tax invoice i e the supplier.

Article explains definitions of credit note and debit note under gst issuance of credit note section 34 1 issuance of debit note section 34 3 format of debit note and credit note details of credit note to be furnished in return section 34 2 details of debit note to be furnished in return section 34 4 and also contains updated extract of section 34 of cgst act 2017. Debit note in gst details of debit notes issued should be furnished in form gstr 1 for the month in which the debit note is issued. These details will be made available to the recipient in form gstr 2a post which the recipient has to accept the details and submit in form gstr 2. For the purpose of gst both debit and credit note need to be issued by the supplier of goods or services.