Bank Charges Gst Code

Kind regards view solution in original post.

Bank charges gst code. So the entry will be like this. Interest charged on late payments. In relation to the bas already lodged i would contact the accountant and ask for their advice in relation to what they would like done about that. Government council rates and water supply charges are not subject to gst.

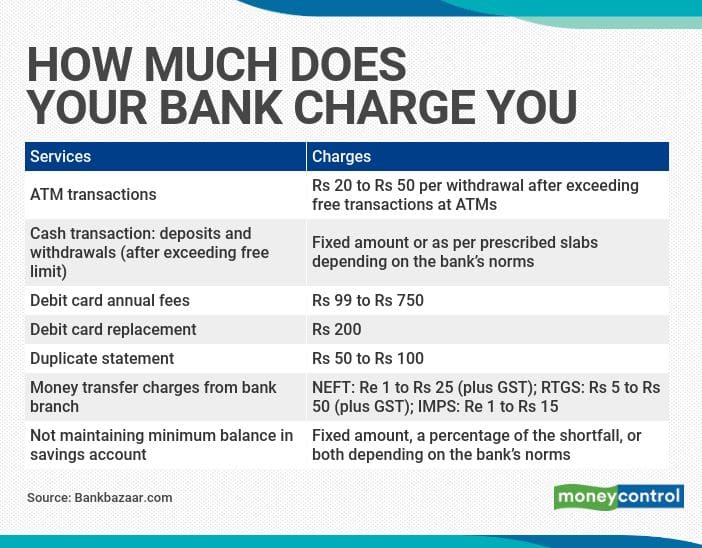

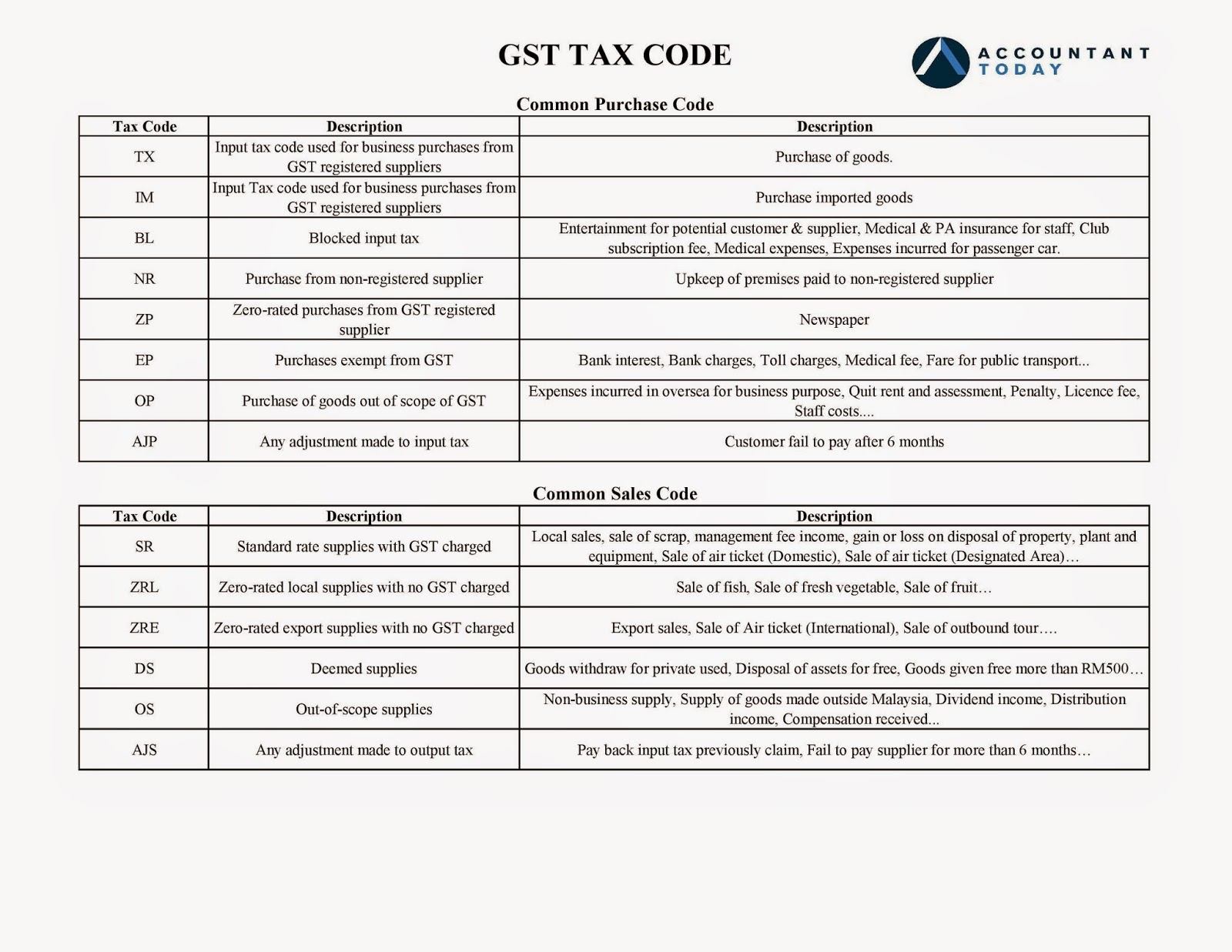

Hi info you can use the out of scope code for bank charges fees. What gst code do i use for bank charges. Interest on loans advances and deposits is exempt from gst. The procedure to find hs code with tax rate is very simple.

Have a great day. Subscribe to rss feed. We show the correct tax code application. In victoria the vehicle registration is broken up into 3 parts.

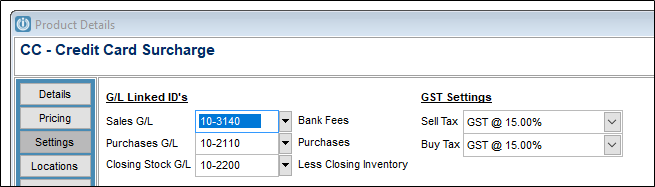

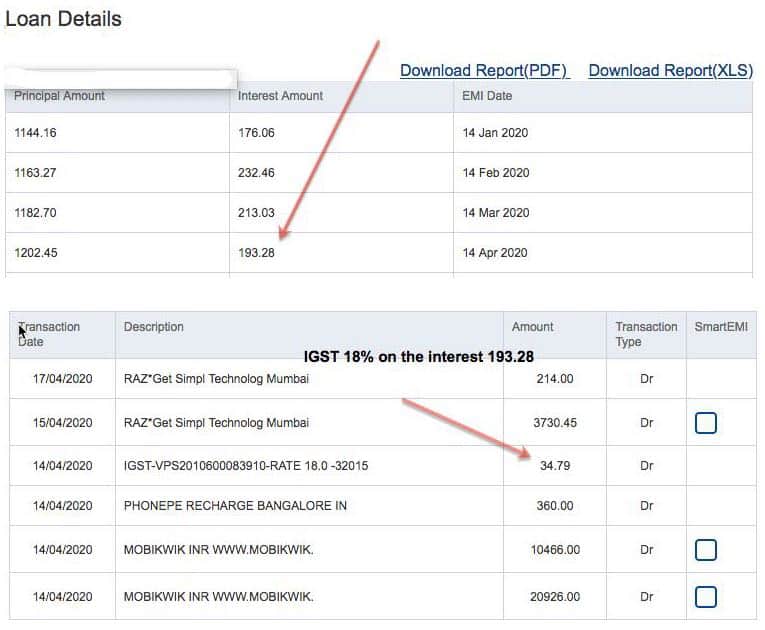

There are two main types of bank fees general bank charges like monthly fee annual fees and merchant banking fees. General bank fees are gst free and merchant bank fees include gst. Hs code goods service discription sgst cgst igst cess conditions. Hsn code and gst rates for our services services hsn code gst rate 1 banking financial services 9971 18 note.

Please contact gstcell centralbank co hsn code and gst rates for our services services hsn code gst rate 1 banking financial services 9971 18. Not applicable march 12 2019 12 46 pm. I ended up calling the ato this afternoon and they advised that both interest paid interest income as well as bank fees should be input taxed. Ambulance levy some states and territories only.

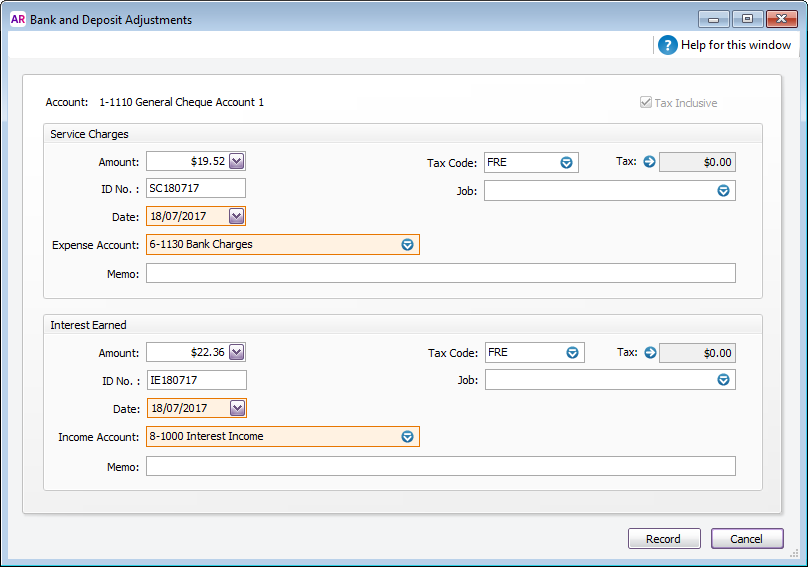

There are many sources that consider interest income and bank charges and sometimes interest expense as input taxed its inp but some others conider them to be gst free. Services by an acquiring bank to any person in relation to settlement of an amount upto two thousand rupees in a single transaction transacted through credit card debit card charge card or other payment card service. Find gst hsn codes with tax rates. Hi dawn101 the correct code for bank charges is fre.

Gst code total amount of invoice as gst and manually override gst dollar amount to reflect gst shown on the invoice. 1b gst on purchases. In this case if my bank within state then bank charge from me cgst and sgst 9 each because gst on bank charges and interest is 18. In above box you need to type discription of product service or hs code and a list of all products with codes and tax rates will be displayed.