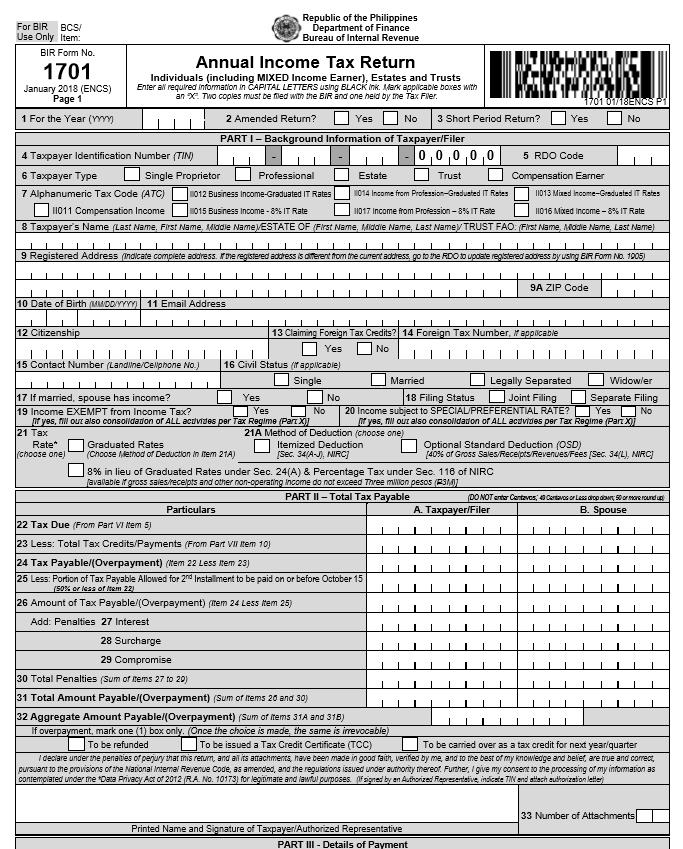

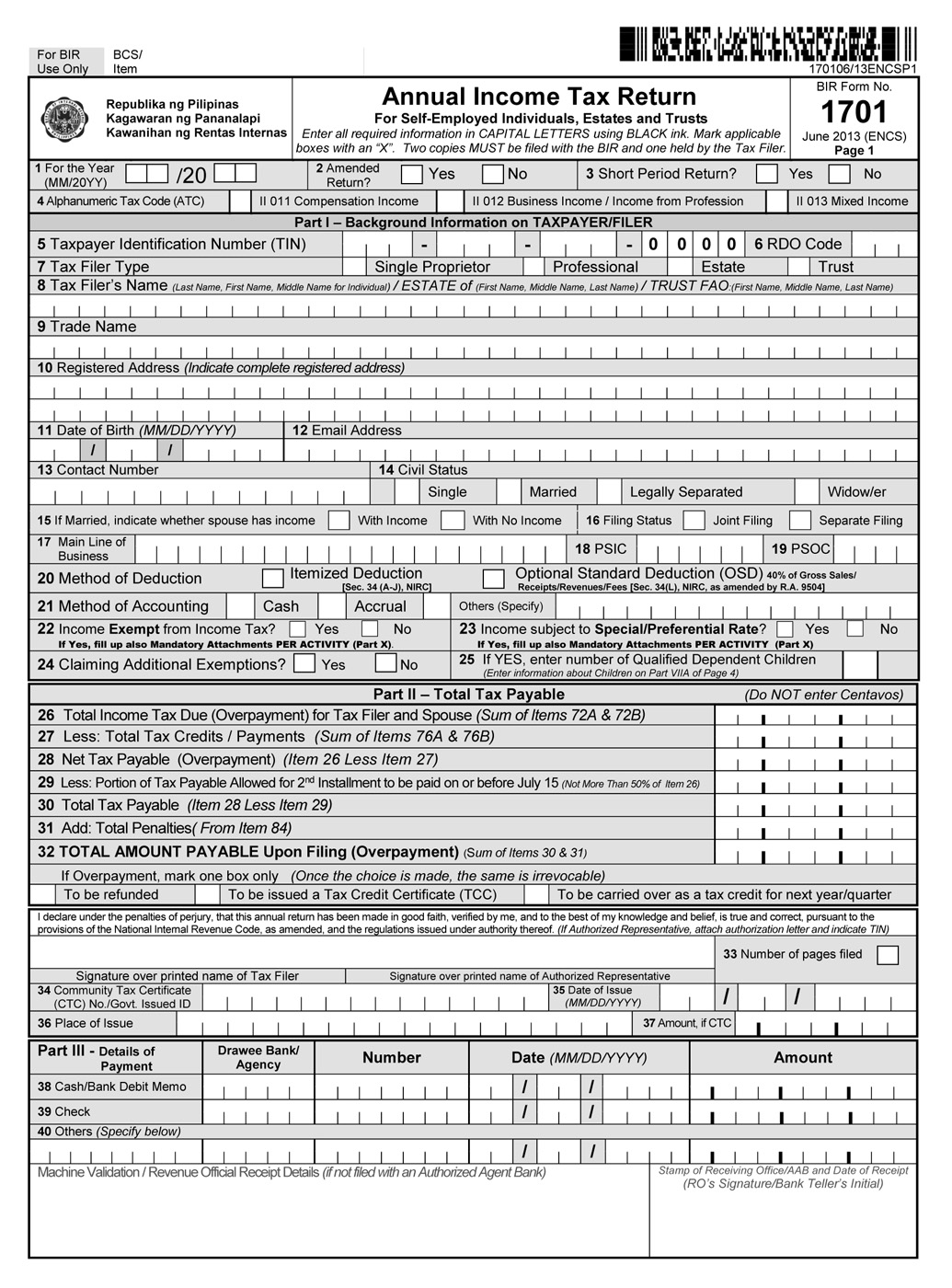

1701 Annual Income Tax Return Bir Form 1701

Please take note that your tax forms will be sent electronically to the bir until 9pm.

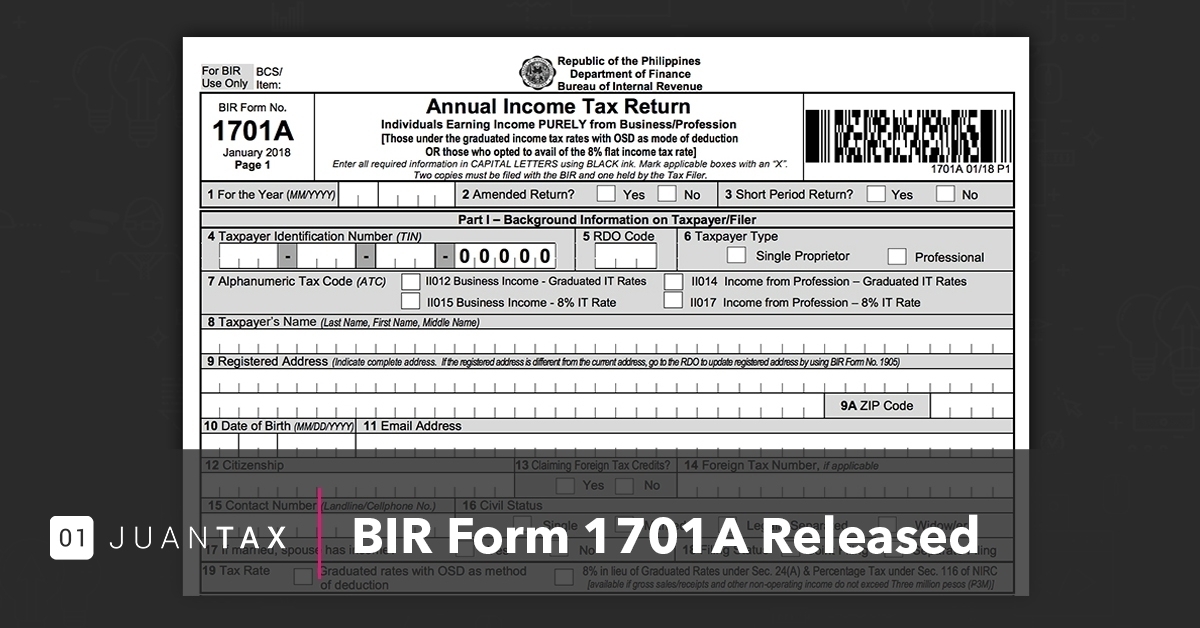

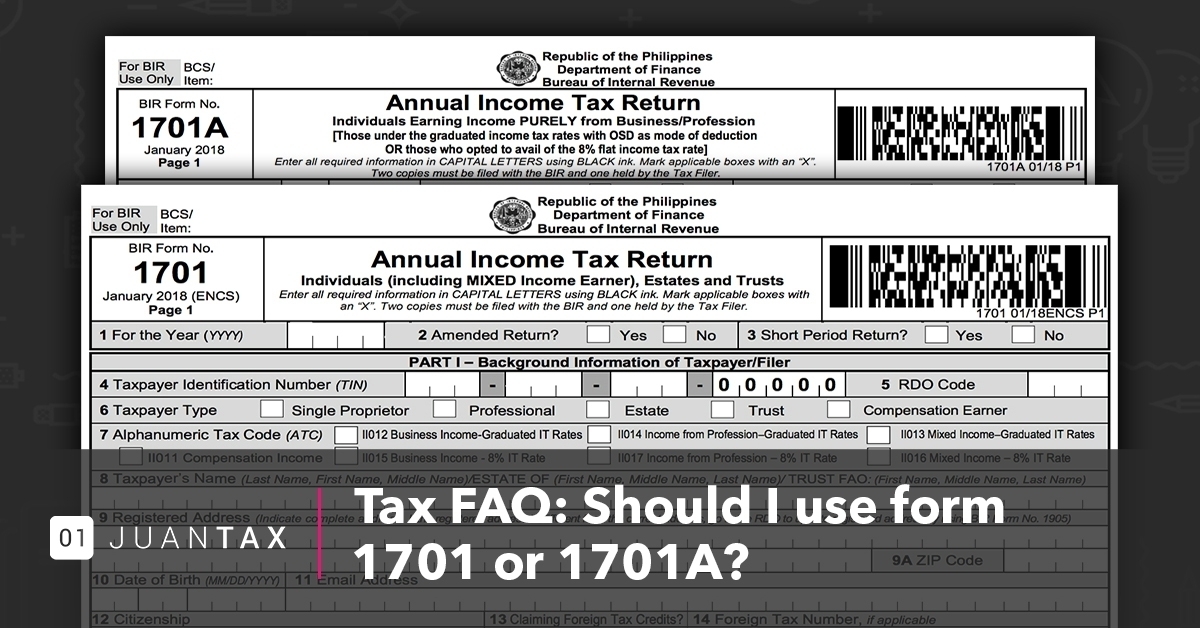

1701 annual income tax return bir form 1701. A resident citizen engaged in trade business or practice of profession within and without the philippines. Any forms that will be sent beyond that filing deadline will be transmitted within the next business day. Bir form 1701a also known as annual income tax return for individuals earning income purely from business profession those under the graduated income tax rates with osd as mode of deduction or those who opted to avail of the 8 flat income tax rate. Annual income tax return for individuals including mixed income earner estates and trusts description bir form no.

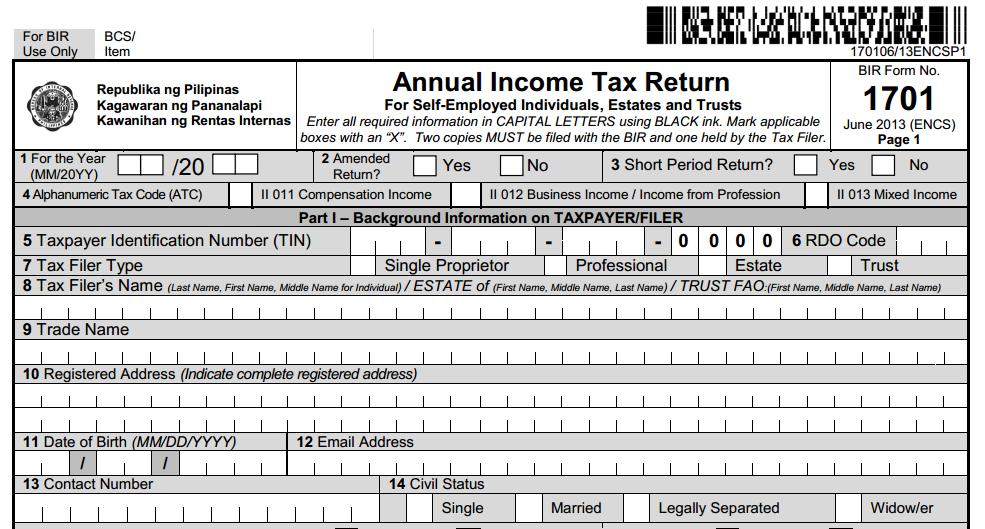

The bir form 1701 or the annual income tax return for self employed individuals estates and trusts shows all the transactions covering the calendar year of the taxpayer. 1701 form needs to be filed on or before april 15th annually and it should cover all those income from the previous tax year. According to bir this must be filed by the following individuals.